Contents

Discover how RPA technology can be leveraged to introduce automation into a variety of financial processes.

What is RPA – and how great is its potential?

RPA, short for Robotic Process Automation, refers to the development and application of software robots (or bots) to perform repetitive, rule-based tasks. In other words, using RPA means letting robots access existing applications through user interfaces and finish human jobs.

RPA is considered by many businesses to be a game-changer whose relevance is growing in the digital world. This can be explained by the following key benefits that leaders can expect when integrating RPA into their workflow:

Bolstering business efficiency

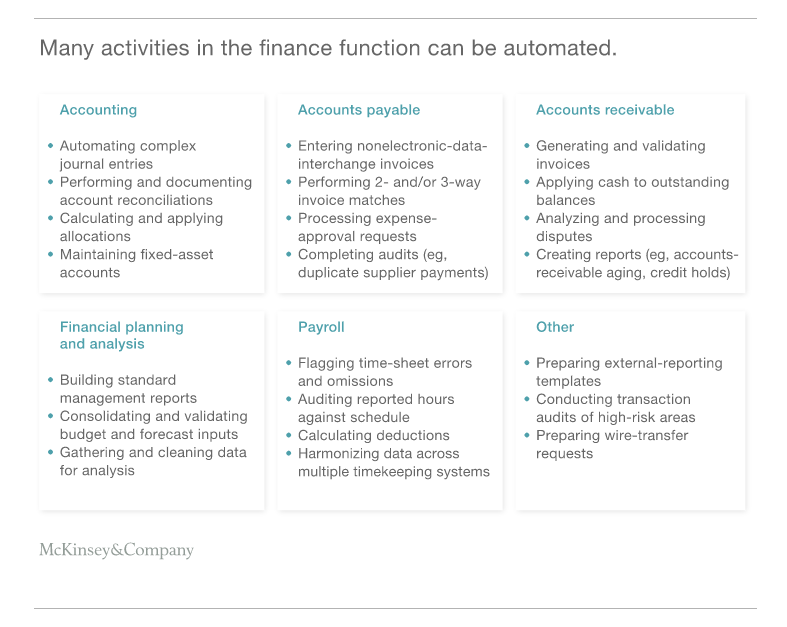

On a typical workday, employees spend 10-25% of their time on repetitive tasks, which negatively impacts a company’s productivity. Meanwhile, according to a report by McKinsey, 42% of activities in financial services firms can be fully automated. This means that the use of RPA, together with many other technologies, will complete tasks rapidly and streamline workflows. Activities ranging from accounting, planning to payroll, and their workflow in general, will benefit greatly from this technology.

Reducing operational costs and achieving high ROI

Task automation means fewer working hours and, thus, lower operation costs. For example, a study from Gartner pointed out that when used properly, for finance departments, RPA can save up to 25,000 unnecessary work hours annually. This figure is translated into $878,000 in savings for a company with a 40-person, full-time finance team.

Another cost-related benefit is higher return-of-investment (ROI) levels since RPA deployment typically has a 12-month payback period.

Reducing human errors and compliance risks

Manual processes are highly prone to mistakes – a 2008 whitepaper from IDC claimed that for multinational enterprises, the annual loss caused by human error is estimated at $62.4 million a year. RPA can increase the reliability of a company’s data processing system, thus reducing the risk of human processing errors, such as missing a fraudulent transaction or miscalculation.

Furthermore, businesses are subject to constant changes in regulations. Bots can be programmed to understand these changes quickly and apply them to the systems, helping the company avoid compliance issues.

Scaling with the development of businesses

The scalability of RPA is considered by many to be a key selling point. The size of a robotic workforce can be adjusted based on the company’s wish. New bots can be trained at the same time to ensure absolute consistency in their performance. The future additional workload will be quickly matched by additional robotic power, which is obviously cheaper than employing new staff.

For the above advantages of RPA, the market size for this technology has already been valued at $1.40 billion in 2019. The figure is predicted to reach $11 billion by 2027, with a compound annual growth rate (CAGR) of 34% during the 2020-2027 period.

Real-life use cases of RPA in the finance industry

Streamlining account payable

Account payable refers to the amount of money that a business owes its suppliers. When a company employs RPA in processing their account payable, data from unstructured documents will be extracted and stored in a centralized space, where it can be automatically calculated and cross-checked if necessary. This acceleration of invoice handling will allow companies to complete payments faster and more accurately, avoiding costly mistakes.

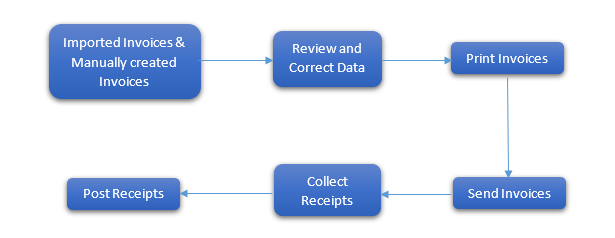

Account receivable

Contrary to account payable, account receivable is the payment a company will obtain from customers for selling its goods and services.

The process itself is rule-based and repetitive, yet it demands precision and consistency. RPA enables the efficient and timely issuing of bills, manages customer master files, and sends late notices automatically. As a result, companies will receive payment faster and accelerate their accounting processes as well.

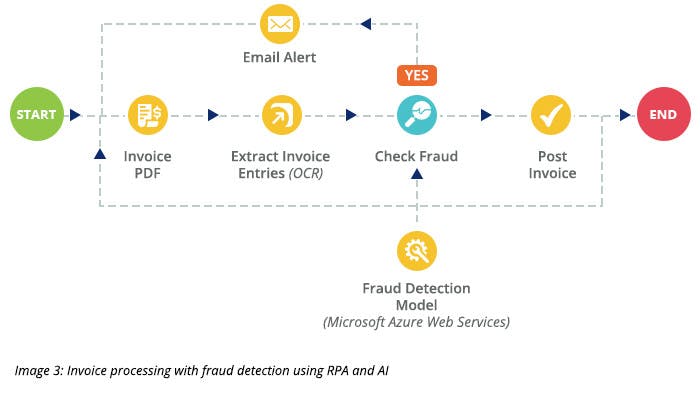

Detecting and preventing fraud

RPA bots can monitor and review streaming financial transactions in real-time. Therefore, uneven patterns that may indicate fraudulent activities will be quickly spotted to trigger any necessary actions. Furthermore, based on current usage patterns, RPA can even predict future attacks by notifying companies about dangers before they happen.

Supporting investment decision making

Software robots can be trained to track investment values, predict future trends and changes, assess investors’ portfolios, etc. These insights are critical to assisting businesses in making informed decisions and minimizing risks. For example, a Colombian bank named Bancolombia launched their RPA solution that offers their clients real-time updates about the fluctuations of the stock market, hence improving their investment decisions.

Managing data across multiple systems

Managing and processing data located in different systems is often challenging for human staff, but it is a rather common reality in businesses. RPA solutions boost the interconnectivity of necessary data by kicking off access to various databases at once.

For example, an RPA-powered solution was created to validate VAT numbers by crosschecking information from a company’s internal ERP data with the online database (VIES). As illustrated below, the robot takes up all the tedious work of sorting data, comparing two datasets, and logging the results in a report.

Bettering financial reporting

Finance experts from many enterprises rely on RPA to automate reporting by performing rapid calculations and yielding accurate, structured results.

RPA’s ability to compile data and review financial reports offloads the manual work from employees and eliminates costly mistakes. According to Gartner, human error in financial functions can lead to, on average, 25,000 hours of extra work hours that could have been avoided, equaling $878,000 per year.

Ensuring contract compliance

RPA bots, combined with natural language processing, can scan through multiple contracts and purchase orders to ensure they are following legal and regulatory guidelines. The technology is also useful in detecting discrepancies and making sure invoices adhere to the terms of vendor contracts. For this reason, with RPA, the manual work previously involved in this process will be removed.

Issuing payroll

RPA completes various tasks relating to issuing payroll, from validating working hours to finalizing calculations, with contractual terms taken into consideration.

Consequently, the payroll process will see a noticeable improvement in their efficiency. The cycle time has been cut down by 40%, and the completion rate when human staff is absent can be as high as 87%.

Financial Planning and Analysis

Analyzing market trends and developing visionary strategies are critical to businesses’ growth. RPA synthesizes data inputs and creates detailed reports, which generate meaningful insights to help forecast new preferences and promote quality planning.

Closing thoughts

The meaningful role of RPA in the finance industry has been seen across business functions and translated into tangible benefits. However, a large proportion of its potential still remains untapped as humans continue to explore the enormous capability of robotic power. In the future, RPA is more than a tool to save costs – it will become a vital element for businesses to thrive.

GEM Corporation is a leading IT service provider who empowers its business clients in their digital transformation journey. Based in Hanoi, Vietnam, GEM is characterized by competent human resources, extensive and highly adaptive techstack, and excellent ISO-certified and CMMi-based delivery process. GEM, therefore, has been trusted by both start-ups and large corporations from many global markets across different domains.Don’t miss our latest updates and events – Follow us on Facebook and LinkedIn!