Contents

As demand in South Korea increases for scalable platforms and specialized technology solutions, both established groups and emerging providers are expanding their presence. This article outlines more than 20 IT companies in South Korea, local and multinational, that are shaping the nation’s tech landscape in 2025.

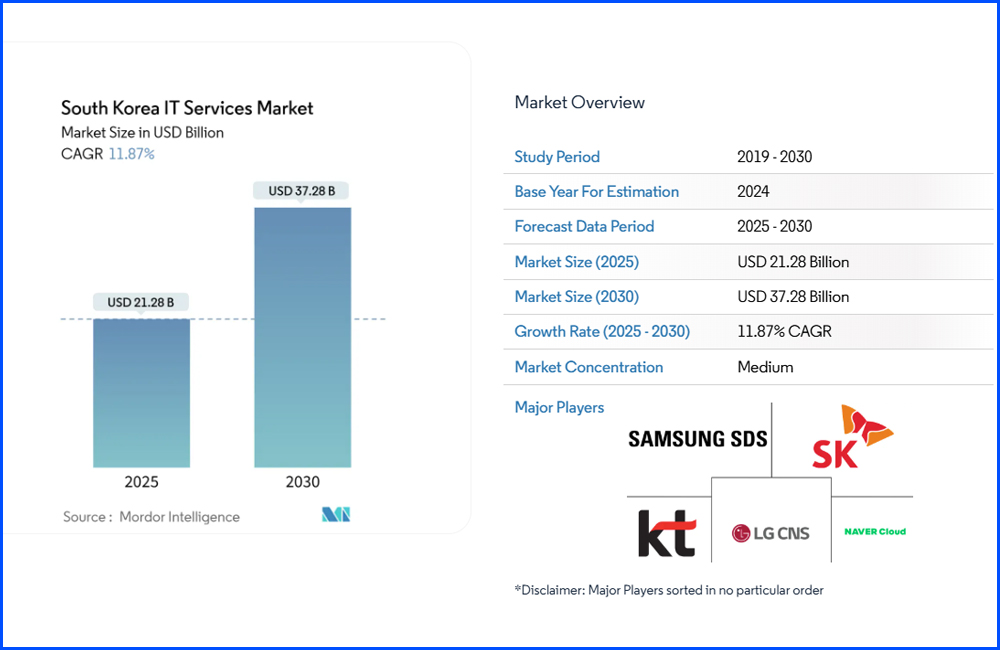

Overview of The IT Service Market in South Korea

Source: https://www.mordorintelligence.com/industry-reports/south-korea-it-services-market

South Korea IT companies are driving one of Asia’s fastest-growing digital service markets, with revenues reaching USD 28.3 billion in 2023 and projected to reach US$13.09bn in 2025. This growth is shaped by a mix of domestic firms and global players operating across cloud services, enterprise software, and digital infrastructure.

The IT services market in South Korea is marked by rapid expansion, strong government backing, and increasing enterprise demand for digital transformation. Below are key factors shaping the market landscape:

Market Size and Growth Trajectory

According to recent data, South Korea’s IT services market is expected to grow to US$39.08bn by 2030 (Statista). This growth reflects rising investment in cloud computing, cybersecurity, and enterprise automation across public and private sectors.

Government and Policy Support

Regulatory frameworks and national digital strategies have contributed to steady market development. Initiatives under Korea’s “Digital New Deal” program are accelerating technology adoption in areas such as data infrastructure, AI integration, and smart city platforms. Public-private partnerships also play a role in expanding IT capabilities nationwide.

Enterprise Demand and Sector Adoption

Large conglomerates, particularly in finance, manufacturing, telecom, and retail, continue to allocate budgets toward system modernization, cloud migration, and data-driven operations. At the same time, small and medium-sized enterprises (SMEs) are seeking scalable IT solutions to improve operational scale and compliance readiness.

Workforce and Talent Supply

South Korea benefits from a strong pool of engineering talent, supported by universities and technical institutes with a focus on computer science and software development. While the domestic workforce meets most demand, some companies are exploring offshore and hybrid delivery models to manage capacity and cost.

Competitive Landscape

The market includes a mix of local firms such as Samsung SDS, LG CNS, and Kakao Enterprise, as well as global players like IBM, Accenture, and Oracle. These firms compete on service quality, technical depth, and long-term delivery models tailored to the Korean business culture.

Top 20+ South Korean IT companies (2025)

Local Companies

First, we will examine the leaders of South Korean IT companies. The domestic IT sector in South Korea is supported by a combination of global conglomerates and digital-native enterprises.

Samsung Electronics Co., Ltd.

Samsung Electronics is certainly the biggest tech company in South Korea. With a diversified portfolio spanning consumer devices, display panels, and memory semiconductors, the company continues to lead in global smartphone shipments and DRAM supply. Its core divisions, Device Solutions (semiconductors), Consumer Electronics, and IT & Mobile Communications, drive sustained innovation backed by one of the largest R&D budgets in Asia. In 2025, Samsung is reinforcing its position in next-generation chip fabrication and AI-integrated devices, strengthening its competitive edge in both B2C and B2B segments.

SK Hynix Inc.

As the world’s second-largest memory chip manufacturer, SK hynix plays a pivotal role in the global semiconductor supply chain. The company focuses on advanced memory solutions such as DRAM, NAND Flash, and emerging technologies designed for AI workloads and data center infrastructure. A member of SK Group, SK hynix has made strategic investments in high-bandwidth memory (HBM) and chip packaging to address growing demand from hyperscale computing and mobile platforms. Its multi-location production and R&D facilities reflect a commitment to long-term capacity expansion and technology leadership.

Naver Corporation

NAVER Corporation has evolved from a dominant local search engine into a diversified tech group operating across content, messaging, fintech, and AI. The company manages South Korea’s leading search portal and owns major platforms such as LINE (messaging), NAVER Webtoon, NAVER Pay, and ZEPETO (metaverse). Its technology roadmap includes investments in robotics, autonomous mobility, and AI-based infrastructure. NAVER’s cloud services unit and enterprise tools are also gaining traction among regional businesses, positioning the company as both a consumer and enterprise tech provider.

Read more: Discover the leading players in Japan’s IT Outsourcing (ITO) market and find out which companies can power your next technology project.

LG Electronics Inc.

LG Electronics has maintained its global presence by focusing on electronics innovation across home appliances, vehicle components, and commercial solutions. The company operates four main business units: Home Appliance & Air Solution, Home Entertainment, Vehicle Component Solutions, and Business Solutions. In recent years, LG has expanded its footprint in B2B verticals such as electric vehicle platforms, smart factories, and healthcare solutions. While consumer electronics remain core, LG’s pivot toward integrated solutions and smart systems reflects its approach to long-term competitiveness.

Kakao

Kakao Corporation has established itself as a digital platform powerhouse in South Korea. Its flagship messaging app, KakaoTalk, commands widespread adoption and serves as a foundation for its broader ecosystem, which includes fintech (Kakao Pay), mobility services, digital content, and cloud-based enterprise tools. The company’s growth strategy centers on platform expansion, AI development, and data infrastructure. With a strong foothold in consumer engagement and digital services, Kakao continues to shape how users and businesses interact in South Korea’s online economy.

Hyundai Autoever

Hyundai Autoever operates as the IT backbone of Hyundai Motor Group, delivering digital solutions across automotive, logistics, and mobility services. The company focuses on system integration, connected car platforms, and mobility software. Its core capabilities include embedded software, digital twins, and data platforms that support smart vehicle development. Hyundai Autoever is also advancing initiatives in autonomous driving and vehicle-to-everything (V2X) communication, aligning with the group’s broader transformation toward software-defined mobility.

Samsung SDS

Samsung SDS functions as the digital transformation engine for Samsung Group and a wide range of external clients. Its offerings span IT consulting, cloud services, logistics platforms, and advanced analytics. The company has invested in AI, blockchain, and cybersecurity to support enterprise modernization in manufacturing, finance, and the public sectors. With its Brightics AI platform and Nexledger blockchain framework, Samsung SDS is positioned among the top South Korean tech companies, combining proprietary solutions with scalable enterprise delivery.

Why Wait? Start Your Digital Transformation Today

Don’t let outdated systems hold you back. With our expertise, you can streamline your operations, embrace innovation, and see measurable results faster than ever

Daou Data

Daou Technology is a publicly listed company specializing in enterprise software, IT infrastructure, and digital marketing tools. Its business extends across IT consulting, data center services, and communication platforms tailored for enterprise clients. The company supports sectors such as finance, telecommunications, and e-commerce, offering solutions in areas like CRM, messaging, and cloud-based collaboration. With a diversified product suite and a focus on business applications, Daou Technology plays a key role in the B2B digital services market in South Korea.

Lotte Innovate Co, Ltd

Lotte Innovate serves as the IT service provider for Lotte Group and external clients across multiple industries. Its portfolio includes IT outsourcing, robotic process automation (RPA), cloud implementation, and offshore delivery. The company supports digital transformation in retail, hospitality, manufacturing, and financial services by providing operational IT systems and industry-specific platforms. Founded in 1996 and based in Seoul, Lotte Innovate combines domain knowledge with tailored service delivery models to support long-term enterprise IT roadmaps.

Shinsegae Information & Communication Inc.

Shinsegae I&C focuses on retail technology and digital infrastructure, serving as the tech arm of Shinsegae Group. The company offers services in cloud computing, AI, and data analytics, with a strong emphasis on smart retail environments. Its solutions include cashier-less stores, digital signage, and customer data platforms. As a retail-first IT provider, Shinsegae I&C is addressing the evolving expectations of consumer behavior through technology, forging new standards in the intersection of commerce and digital transformation.

Read more: Explore the top IT Outsourcing (ITO) companies in Australia and uncover the best partners to elevate your technology projects.

Multinational organizations

Global technology firms play a significant role in South Korea’s IT services market, partnering with local enterprises and public institutions to deliver solutions in cloud computing, enterprise software, data infrastructure, and customer engagement.

Microsoft

Microsoft is a key player in enterprise cloud adoption, with services centered around Microsoft Azure, Microsoft 365, and Dynamics 365. The company supports South Korean organizations in migrating legacy systems, building AI-powered applications, and deploying secure hybrid cloud environments. Microsoft collaborates closely with local conglomerates, SMEs, and public agencies, aligning its initiatives with national digital strategies. Its AI Co-Innovation Lab in Seoul reflects an ongoing commitment to R&D and talent development in the region.

Google maintains a robust presence in South Korea through its cloud division, developer ecosystem, and digital services. Google Cloud supports enterprises with infrastructure modernization, data analytics, and AI-based solutions. The company also invests in local startups and partners through its Google for Startups Campus in Seoul. In sectors such as retail, finance, and gaming, Google’s platforms, including Android, Google Ads, and YouTube, play a pivotal role in digital engagement and monetization.

Apple

Apple’s footprint in South Korea is centered on its consumer hardware ecosystem, supported by regional retail and service infrastructure. While Apple does not operate large-scale enterprise services in-country, its platforms, iOS, iCloud, and App Store, support a growing base of Korean developers and fintech providers. Apple also engages local suppliers in its hardware value chain, contributing to the broader ICT manufacturing landscape.

Read more: Discover the leading IT companies in Norway and find the right technology partners to drive your digital transformation forward.

SAP

SAP Korea delivers enterprise application software to leading South Korean firms in manufacturing, retail, and financial services. Its ERP and supply chain solutions are widely adopted by conglomerates seeking operational transparency and real-time data integration. SAP has localized its offerings to meet South Korean regulatory and tax requirements, and its partnerships with major system integrators expand its implementation capacity in the market. The company is also advancing cloud migration through the SAP Business Technology Platform and S/4HANA deployments.

Salesforce

Salesforce Korea focuses on cloud-based CRM and customer engagement platforms. Its offerings support companies in managing sales, customer service, and marketing automation through tools such as Sales Cloud, Service Cloud, and Marketing Cloud. Salesforce’s presence in South Korea is growing, particularly in sectors such as telecom, finance, and digital commerce, where customer experience is a key competitive differentiator. The company also fosters a local partner ecosystem to accelerate adoption and integration.

Cisco

Cisco Korea provides infrastructure and cybersecurity solutions to enterprises, telecom operators, and government agencies. Its portfolio covers secure networking, collaboration tools (Webex), and edge-to-cloud infrastructure. Cisco is involved in national smart city initiatives and works with educational institutions to expand digital skills through its Networking Academy program. As South Korea advances its 5G and IoT infrastructure, Cisco’s technology supports the backbone of connectivity and secure data exchange.

Software development companies

South Korea’s demand for software development services has created strong opportunities for regional providers with scalable delivery models, multilingual capabilities, and sector-specific expertise.

GEM Corporation

GEM Corporation is a global IT services and consulting firm with an increasing presence in South Korea’s enterprise technology landscape. Since entering the market, we have supported clients across telecommunications, retail, logistics, and manufacturing, often as a long-term partner on digital transformation initiatives or as a project accelerator for time-sensitive deployments. With our bilingual delivery teams and agile execution model, we align well with the pace and expectations of Korean businesses.

Founded in 2014, GEM has built a reputation for delivering scalable, high-impact solutions across Asia-Pacific, Japan, and Europe. Its Korean portfolio reflects both depth and flexibility, ranging from full-cycle product engineering to systems integration and cloud modernization.

Key capabilities and credentials include:

- 400+ engineers and consultants worldwide, including cross-functional teams serving Korean clients

- Experience in custom software development, QA automation, cloud migration, and enterprise application modernization

- ISO/IEC 27001:2022, ISO 9001:2015 certified; CMMI Level 3 appraised for software development

- ISTQB Gold Partner, ensuring governance and testing standards in large-scale QA programs

- Official Consulting Partner of Databricks and ServiceNow, with active projects in AI, data transformation, and ITSM

- Ongoing delivery of bilingual, co-located teams for Korean enterprises seeking scalable offshore/nearshore collaboration

GEM’s approach emphasizes speed, product quality, and measurable outcomes, an operating philosophy that resonates with South Korea’s innovation-driven, execution-focused technology environment.

Make your digital transformation seamless and future-ready Accelerate your business growth with zero-disruption modernization services. Maximize the value of your current infrastructure, streamline processes, and cut expenses.

FPT Software

FPT Software is one of the largest IT service providers in Southeast Asia, with a broad footprint across Asia-Pacific and North America. The company has maintained an active presence in South Korea, supporting digital transformation initiatives through enterprise software development, legacy modernization, and cloud services. FPT’s established delivery centers and Korean-speaking engineers allow for smooth collaboration, particularly in manufacturing, automotive, and banking sectors. Its partnerships with global technology vendors further strengthen its ability to deliver integrated solutions at scale.

CMC Global

CMC Global, a subsidiary of Vietnam’s CMC Corporation, offers full-cycle software development services and IT outsourcing, with a specific focus on Japanese and Korean markets. The company provides services in areas such as system integration, cloud services, and application development. Its Korean client base includes enterprise customers seeking nearshore delivery for both brownfield modernization and greenfield development. CMC Global emphasizes local market alignment through bilingual support and domain-specific knowledge.

TMA Solutions

With over 20 years of industry experience, TMA Solutions is one of Vietnam’s longest-standing software service providers. The company has served clients in South Korea across telecom, healthcare, and e-commerce sectors. Its technical capabilities span AI, IoT, and enterprise systems, with delivery centers equipped to manage large-scale, multi-year engagements. TMA’s focus on R&D and innovation has positioned it as a technology partner for Korean firms undergoing digital product development or platform expansion.

Rikkeisoft

Rikkeisoft is a fast-growing Vietnamese IT services company offering software development, QA, and BPO services. It has built a strong presence in East Asia, including South Korea, where it supports clients in mobile app development, system maintenance, and cloud integration. The company emphasizes flexibility in team scaling, cost-efficiency, and quality assurance. With a growing base of Korean-speaking engineers and account managers, Rikkeisoft is strengthening its role as a nearshore technology partner for businesses in the region.

Read more: Discover the top IT companies in the UK and explore potential partners for cutting‑edge technology collaborations and innovation.

How to Select a Suitable South Korea IT Company for Your Business?

Choosing the right IT partner in South Korea means balancing technical capability with cultural alignment, delivery structure, and long-term adaptability. The country’s IT landscape is shaped by both large domestic firms and agile global players, each offering different advantages depending on the scale and complexity of your needs.

Here are key factors to consider during vendor evaluation:

- Sector Familiarity

Look for companies that have delivered projects in your industry or in adjacent verticals. Familiarity with sector-specific systems, user behaviors, and compliance environments often shortens onboarding and improves delivery accuracy. - Delivery Model and Team Composition

Clarify whether the firm offers fully onshore, hybrid, or offshore delivery. In South Korea, bilingual teams and real-time collaboration models can be decisive for communication flow, especially in high-velocity projects. - Technology Breadth and Depth

Review the company’s portfolio across core areas – custom development, cloud infrastructure, QA, AI, or platform integration. Depth in one area is useful, but cross-functional strength is often more valuable in complex environments. - Execution Track Record

Examine past case studies and client references. Proven experience with multi-phase rollouts or mission-critical systems gives insight into how the company handles uncertainty, scale, and change requests. - Certifications and Quality Standards

ISO, CMMI, or partner badges from global platforms (e.g., AWS, ServiceNow, Databricks) reflect the company’s operational maturity and alignment with international practices. - Support and Post-Delivery Engagement

Ask about long-term support, platform maintenance, and optimization services. A partner who can evolve with your business is more valuable than one focused solely on project delivery.

Conclusion

South Korea IT companies reflect a balanced mix of global reach, sector depth, and innovation-led strategy. From semiconductor giants and digital platform leaders to specialized service providers and multinational players, the ecosystem remains diverse and growth-oriented. Local firms are scaling advanced technologies, while foreign companies bring global frameworks and infrastructure. Meanwhile, regional software developers are forming long-term partnerships to support transformation agendas. As demand continues across cloud, AI, and enterprise services, these companies are positioned to shape the country’s digital trajectory into 2025 and beyond.

To explore how GEM can support your digital initiatives with tailored software solutions and proven delivery, contact our team today!

What types of IT companies are included in the top 20+ list?

The list includes a mix of major domestic corporations, global consulting firms with local operations, and high-performing software development companies. Each brings a different value proposition depending on the client’s goals and project scale.

Why are multinational IT firms gaining traction in the Korean market?

Global IT firms often offer broader technical stacks, bilingual project teams, and delivery flexibility. Their familiarity with international standards and cross-border system integration appeals to Korean enterprises expanding globally.

What sets software-focused IT companies apart in South Korea?

Software-focused firms tend to be more agile and innovation-driven. They often specialize in areas like application development, QA automation, and platform integration, making them a good fit for fast-moving projects or startups.

How can a business identify the right IT company in South Korea?

Key evaluation points include the vendor’s industry experience, delivery model, communication structure, certifications, and ability to support long-term growth. Alignment on both technical and operational levels is central to a successful partnership.