The next generation of the internet that will revolutionize the financial industry is blockchain.

Blockchain technology has shaken all industries, especially the financial sector when it powers Bitcoins with practically irreversible transactions.

It helps users securely record transactional histories such as amount, date, time, and any unique digital signatures in a decentralized system. It is just one significant example among many other applications of blockchain in the finance sector.

So, what is blockchain?

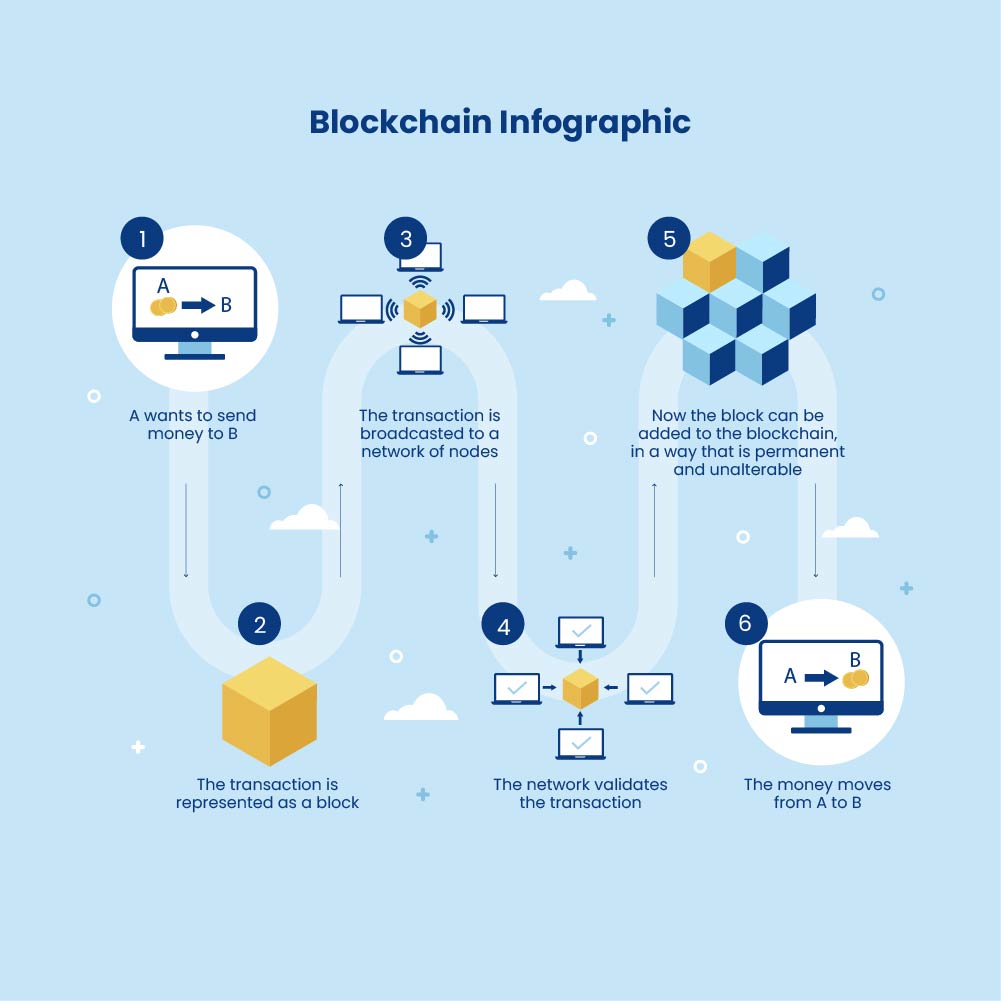

Blockchain is a public ledger that enables the transaction and trade of electronic assets in real-time. Its algorithm allows storing transactional data as blocks. Then, these blocks are chained together and synchronized across multiple computers in a network without owners.

The feature of decentralization, transparency, and immutability is generating significant attention across industries. The financial sector is among the firsts to implement this pragmatic yet revolutionary technology.

Here are significant applications of blockchain that financial service providers could harness.

Cross-border money transfer

Every year, cross-border transfer value is up to hundreds of billions of dollars. As the E-commerce explosion shows no signs of slowing down, the demand for cross-border money transfer is growing. Unfortunately, international transactions are usually expensive, laborious, and time-consuming for financial institutions and consumers.

Banks have been the most common remittance channel, besides other nonbank financial institutions and money transfer operators. Their transaction procedure requires never-ending chains of intermediaries, manual paperwork, and hidden charges, for example, foreign transaction fees and exchange rates. According to The World Bank, an average cost reached 11% in the first quarter of 2019. The transfer time could take up to a week.

In fact, many banks have been upgrading their international payments with blockchain to save time and money. Based on distributed ledger technology (DLT), the system creates digital blocks of transactions distributes them to a network of multiple computers for verification when buyers submit payments to their banks.

Once successfully warranted, the trades are approved and posted to the ledger. Designated parties are also notified in real-time to execute. With the exclusion of third parties, blockchain makes the process faster, more accurate, and less expensive.

Moreover, banking institutions could offer their clients a highly secure payment method, as no one can adjust or tamper with recorded transactions.

Blockchain-based smart contracts

Traditional finance often shows a series of problems for financial institutions and their clients. The fragmented and inefficient financial systems require multiple parties and levels of manual processing.

As a result, banks confront high operating costs, the probability of fraud whilst buyers and sellers have to face numerous paper documents and delays due to poor customer service. This explains why there is so much interest in blockchain and smart contracts.

Smart contracts are implemented by a computer network that programs consensus protocols as the contract into a sequence of automatic actions. Blockchain is not just for storing financial records but rather automatically executing terms of multiparty agreements.

Trade Finance stands to benefit from this innovation when it replaces paperwork and improves coordination among the parties involved. In the smart system, all parties to the contract can access and approve the transaction.

Then, transactions are automated upon predefined agreements with reduced risk of error or manipulation. Its automation also mitigates labor-intensive banking operations in the payment processes.

Moreover, smart contracts help the business customers enhance intercompany transparency and trust. Blockchain creates a distributed transaction database that allows all parties to trace arrangements and supporting documentation and instantly reconcile accounting entries. That makes their financial processes more permanent and immutable.

Blockchain technology has great potential to create a new wave of innovation to financial technology, even if it is still in the early stage of development and deployment.

The industry leaders are investing more in exploiting this technology sufficiently. With many benefits, blockchain promises to provide various opportunities to flourish the financial industry and others in the new digital economy.

Read more: Blockchain and healthcare data storage: Pushing for seamless integration and strengthened security

ABOUT GEM

GEM Corporation is a leading IT service provider who empowers its business clients in their digital transformation journey. Based in Hanoi, Vietnam, GEM is characterized by competent human resources, extensive and highly adaptive techstack, and excellent ISO-certified and CMMi-based delivery process. GEM, therefore, has been trusted by both start-ups and large corporations from many global markets across different domains.

Don’t miss our latest updates and events – Follow us on Facebook and LinkedIn!