Contents

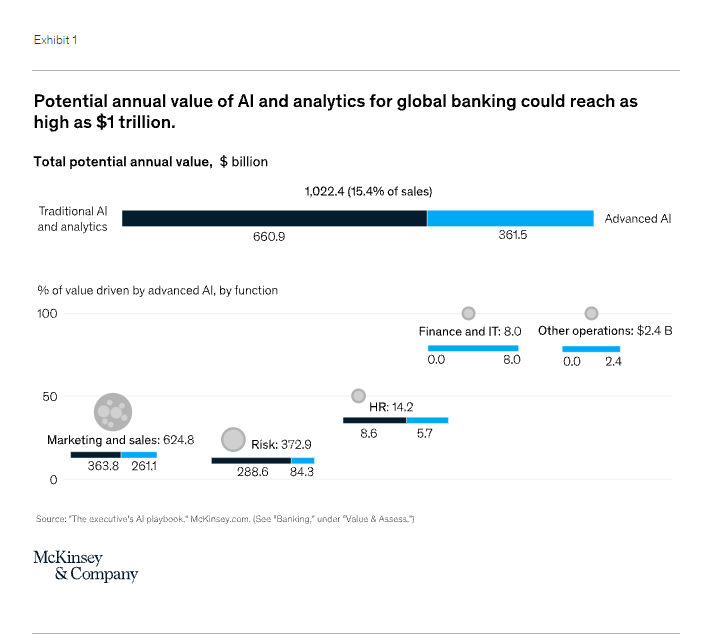

Artificial Intelligence technologies play a significant role. “Two-thirds of banking executives (66%) said new technologies such as AI, cloud, and DevOps will continue to drive global banking transformation over the next five years

Introduction

Know-Your-Customer (KYC) has always been a pain for banks and their customers for its duplicative, lengthy, and complicated process. And yet, with AI and biometric technology, eKYC (electronic KYC) is now much more accessible. Customers can now open their bank account online without being physically present. eKYC enables banks to convert customers much more quickly. And if banks can’t catch up, they will be losing market shares to more tech-savvy competitors.

That’s how eKYC is fueling the digital banking revolution in Asia. But there is more than just eKYC in digitization and technology adoption for banks. KPMG has keyed six strategic themes to bring meaningful impacts towards banks’ digitization process:

- Simplifying Journeys and Using Digital Partners to Drive Customer Centricity

- Strengthening Cyber Security to Manage Increased Digital Traffic and Control IT Risks

- Rationalizing the Application Landscape to Drive Cost Reductions and Control IT Risks

- Using Cloud Technology to Increase Flexibility while Lowering Costs

- Strategic IT Outsourcing to Increase Operational Resilience and Flexibility

- Leveraging Blockchain to Facilitate ESG-Reporting and Practices.

In this process, AI technologies play a significant role. “Two-thirds of banking executives (66%) said new technologies such as AI, cloud, and DevOps will continue to drive global banking transformation over the next five years.” Temenos report

With massive amounts of data, AI can improve the customer experience. It can also be trained to detect, assess risks, prevent fraud cases, and help banks comply with regulatory requirements. And by automating manual tasks, AI can save operational costs for banks.

Before COVID-19, banks have been amongst the leading AI adopters, along with the technology sector. But as the pandemic comes, the business case for AI has been less convincing for two reasons. Firstly, machine learning models on historical data are less likely to be relevant. Secondly, weak profitability might be draining banks’ budgets and patience for digital transformation.

While COVID-19 could have slowed down the process for AI adoption in banks, the benefit that AI can bring will still outweigh the cost in the long term. And as the use of online and mobile banking keep increasing, AI’s relevance is as much as the opportunities it brings.

This article will be discussing the following topics regarding AI adoptions in banking:

- The state of AI adoption in banks

- Primary use cases of AI in banks

- Steps towards AI adoptions for banks

State of AI adoption in banks

In a study by the Economists Intelligence Unit (EIU) on Artificial Intelligence and the future of financial services, there are a few key findings on the adoption of AI in banks:

- Investment banks are emerging as trendsetters

- From a regional perspective, Asia Pacific (APAC) heads the pack

- A wide range of AI technologies have been implemented by banks and insurers alike

- Customers and stakeholders satisfaction were the primary measures of AI success

- The transformation native of these technologies will be profound

- The most significant perceived barrier to broader adoption of AI is cost.

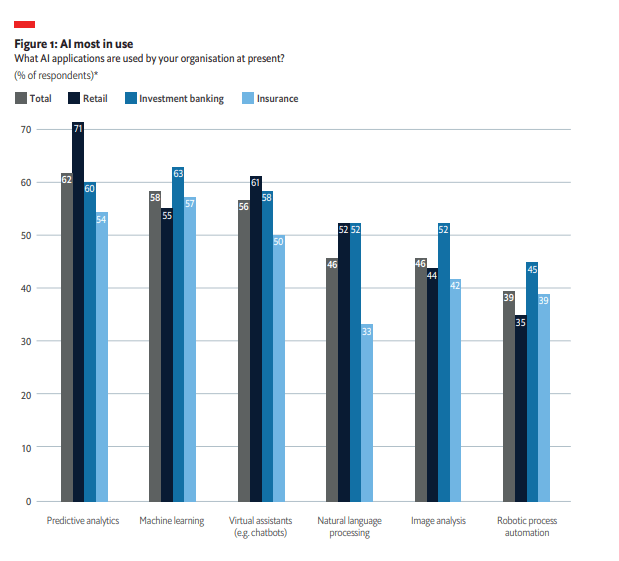

AI applications most in used

Amongst AI heavy adopters, predictive analytics (62%), machine learning (58%), and virtual assistants (56%) are the most popular applications. Natural language processing (NLP) and image analysis ranked fourth at 46% of the total respondents. RPA is currently the application with the lowest rate at 39%.

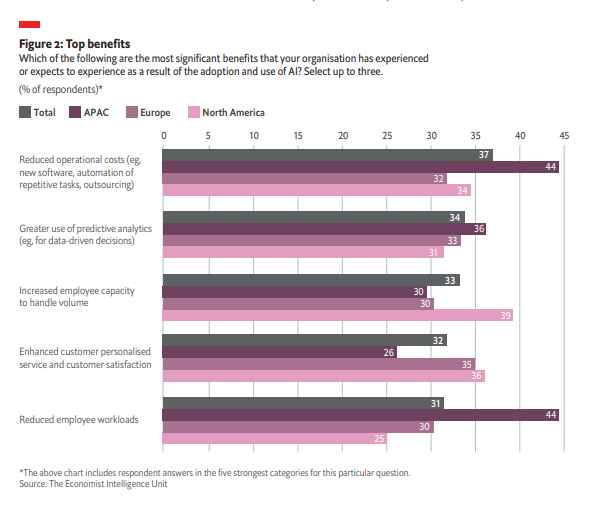

Top benefits

The most prominent benefit of AI adoption is reduced operational costs (e.g., new software, automation of repetitive tasks, outsourcing)(62%). And that is followed closely by greater use of predictive analytics (e.g., for data-driven decisions), increased employee capacity to handle the volume, enhanced customer personalized service and customer satisfaction, and reduced employee workload.

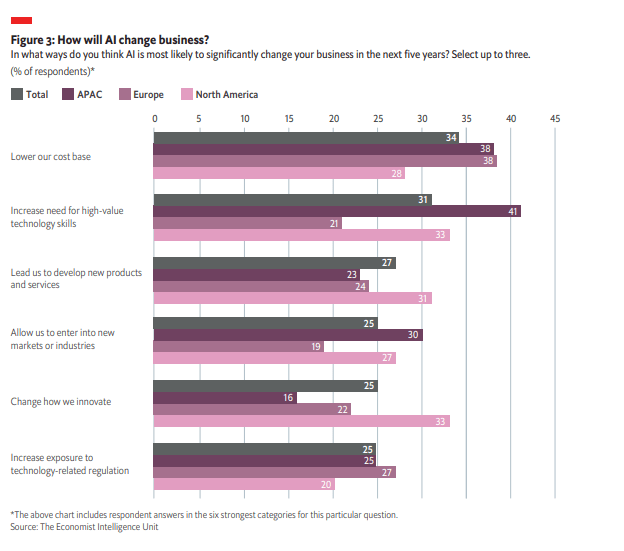

How will AI change business?

Amongst the changes that AI is perceived to make in the next five years, the most impactful change would be a lower cost base (34%). Followed is an increased need for high-value technology skills (31%), lead to new product and service development (27%). The last three changes are equally significant to 25% of the total respondent, varies a little between different regions: allow entrance in new markets or industries, change how banks innovate and increase exposure to technology-related regulation.

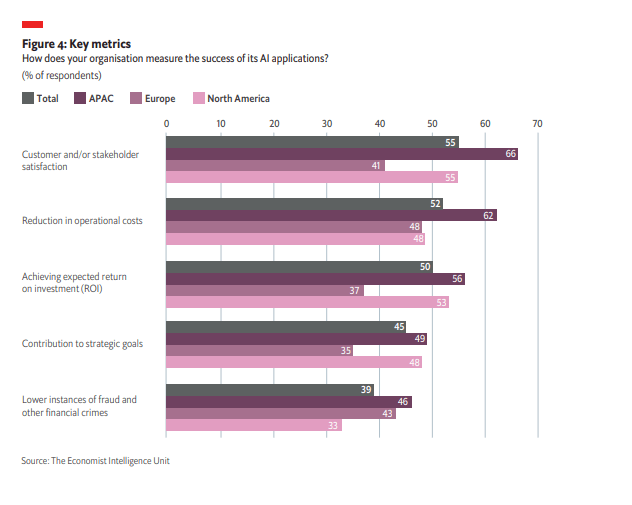

Key success metrics

Customer and stakeholder satisfaction is the most important critical success metric for AI adoptions, chosen by 55% of respondents. The following factors are reduction in operational costs (52%), achieving expected return on investment (ROI)(50%), and contributing to strategic goals (45%). The last factor is lower instances of fraud and other financial crimes (39%).

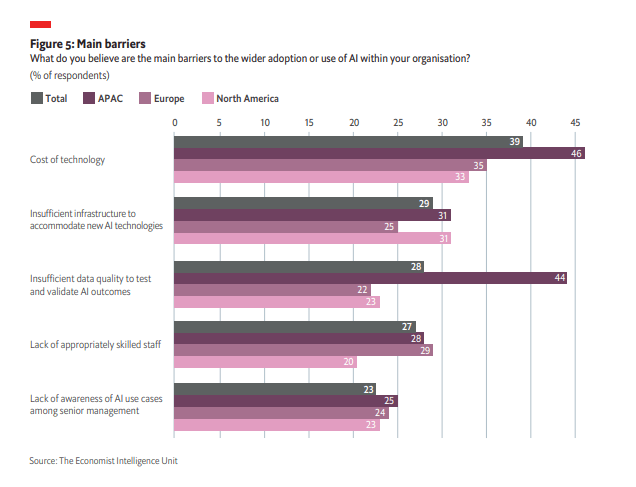

Main barriers

The most significant barrier that is holding organizations back from adopting AI is the cost of technology (39%). The following barriers are insufficient infrastructure (29%) and data quality (28%) to back up AI technology. And finally, there’s a lack of awareness (23%) of AI use cases among senior management.

How is artificial intelligence used in banking?

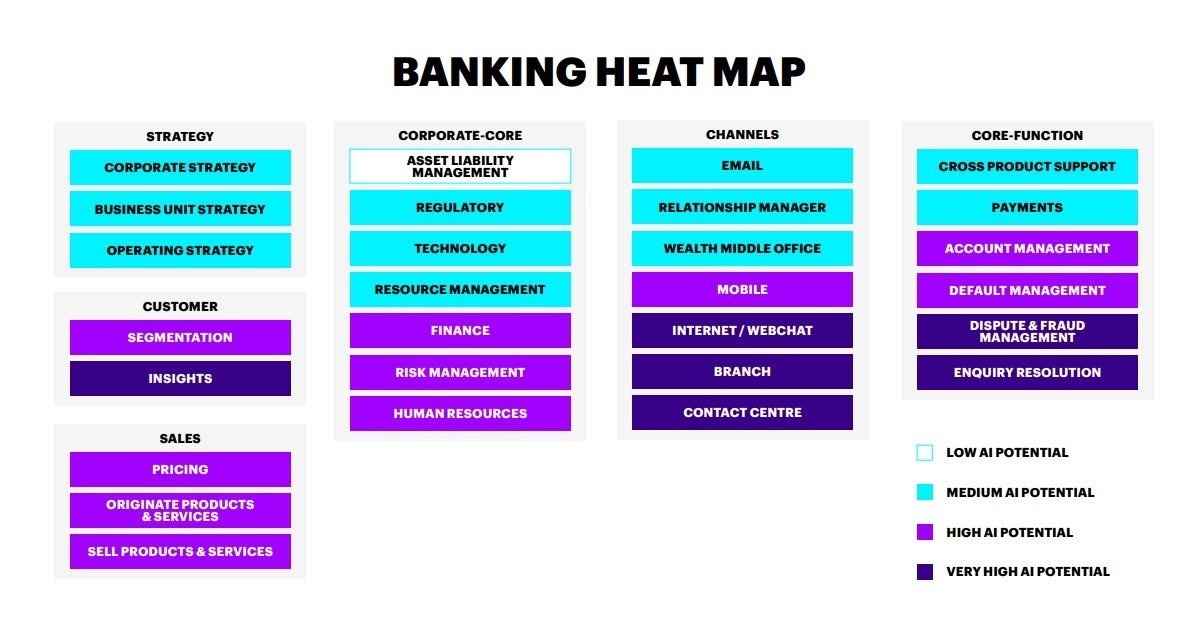

Accenture has mapped out a Banking Heat Map to understand how AI can renovate the existing bank systems in a recent report.

AI implementations revolutionize the client service for the front office and maximize the efficiency in the back and middle offices’ operations.

The middle office can use AI to power the detection and prevention of fraud. AI can perform real-time regulatory checks for anti-money laundering and Know-your-customer obligations in vast amounts of data.

Overall, it can identify potentially fraudulent transactions more swiftly and accurately than traditional methods relying on human staff.

This section will discuss a few notable use cases of AI and examples to demonstrate how it can improve bank operations.

Improving customer engagement and experience

This is the clearest AI use case for any business. With the constant development of digital services, customers are expecting a more seamless experience. With AI, banks can offer an intelligent, personalized, and omnichannel experience for their customers.

Chatbots and virtual assistants can provide customer support 24/7. They could offer clients instant assistance in mobile banking setup, guidance on opening saving accounts, and other frequently asked questions. The automated bots will also help bankers quickly process simple yet time-consuming queries like processing credit card bills or generating bank statements.

AI-based chatbots are built using Natural Language Processing (NLP) and Machine Learning (ML). Thousands of pages of guides and documents can be turned into questions databases and programmed into the support bot.

HSBC, one of the world’s largest financial services institutions, HSBC has employed chatbots and yielded remarkable outcomes. In 2019, the bank held 10 million chat conversations, reducing emails on simple trade statuses by 30 percent a month. They expect to handle 10 million a month by 2024.

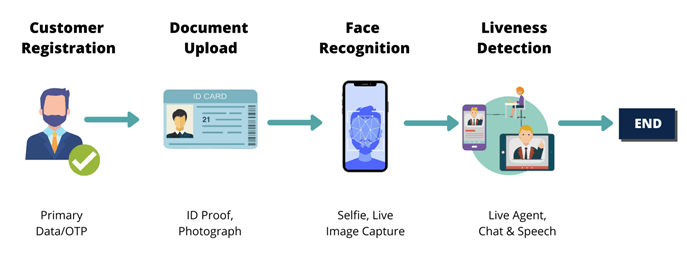

e-KYC systems, as we have mentioned in the introduction, can be empowered with Machine Learning to verify customer identity by recognizing government-issued IDs. Then it can match the data with facial biometrics to a picture or a video of a customer. Distinctive human features, such as the face, fingerprints, and voice, are converted into code that the AI system can read.

This encoded information is saved in a database to identify digital scams and accelerate the verification process.

Personalized customer experience is another use case for AI. In an article by McKinsey&Company, they have mapped out some personalized experiences that a bank can provide with AI and customer data.

- Analytics-backed personalization offers

- Personalized money-management solutions

- Aggregated overview of daily activities

- Savings and investment recommendations

Royal Bank of Canada launched a full suite of personalized automated banking experiences called NOMI. It provided customers with monthly cashflow analytics, budget recommendations, and automated saving funds. RBC has increased 3% in mobile banking utilization growth from 2015 to 2019.

Credit service and loan decision

Credit and loan decisions used to be made based on a person or company’s credit scores, history, customers reference, and banking transactions. However, the existing credit systems lack real-world information and cannot consider the credit scores of those without a credit history.

Meanwhile, Machine Learning algorithms can further analyze behaviors and spending patterns to predict individual creditworthiness. An example is Lenddo – a startup aggressively using advanced machine learning to go through alternative data to determining creditworthiness. They have reported allowing their lending partners to approve up to 50% more applications.

However, there have been concerns regarding the biases in ML models due to biased credit decision data. Therefore, it is crucial to investigate and remove bias from data before making a model or picking better goals for models that discriminate.

Fraud monitoring and detection

With banks conducting more business online, fraud detection and identity verification technology are even more vital. According to an article by TechTarget, successful fraudsters today take advantage of advanced technologies like API and big data to help steal money.

Capital One train its ML models on a data set including credit card transactions and demographic information. Then it uses 6 “W’s” (what, who, when, where, why, and what if) to uncover fraud activities. Then, if a fraudulent transaction is detected, it will immediately notify the customers’ phone. The customer can mark whether the purchase is legitimate; if not, the bank will lock down the card instantly.

Automated investment

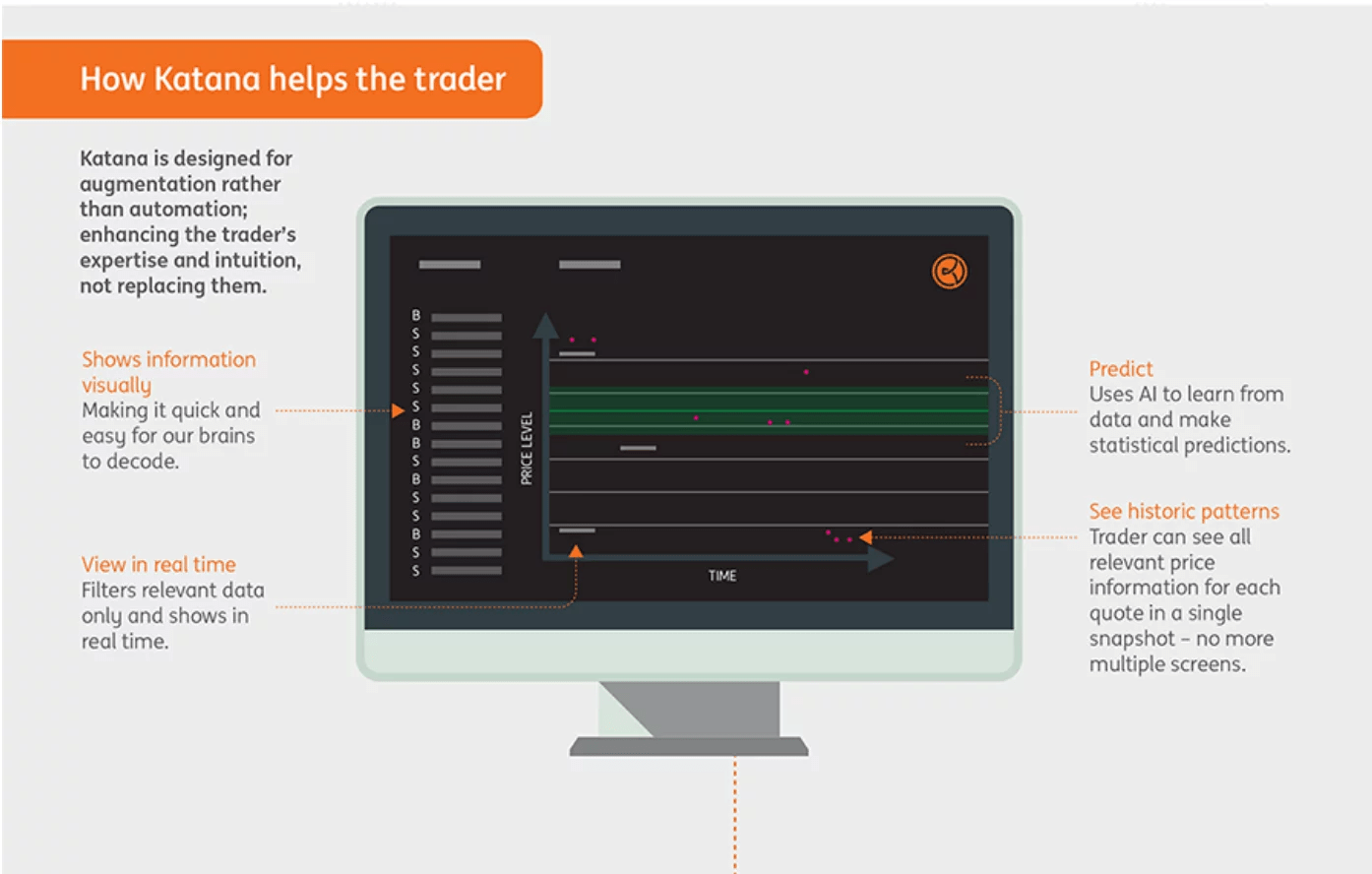

For investment banks, AI can help with trade processing, using predictive analytics to help traders, and automating market data collection to identify investment opportunities.

An example is Katana – a bond trading tool launched by ING – a major Dutch bank. It can forecast what prices could win a trade, providing traders with recent price trends and relevant data. It is reported to have a 25% reduction in trading costs and making faster decisions on 90% of trades.

Regulatory Compliance

For banks, it is essential to update their processes and workflows to comply with the latest regulations. Most banks’ internal compliance team has to go through thousands of web pages and internal documents; then decide which changes need immediate attention. This time-consuming process brings no additional revenues for banks.

An AI software can reduce effort on this process by scouring through the web and identifying only the company’s most relevant ones. An AI virtual assistant can also help to monitor wire transfers, prevent money laundering, and uphold customer privacy.

AI-enhanced security

According to the IBM Security X-Force report, cyberattacks on the banking sector accounted for 23% of total attacks on the top 10 industries since banks hold massive sensitive information related to customers and companies with accounts.

With the help of Natural Language Processing (NLP), banks can analyze large amounts of emails and information to find information that indicates potential threats. And Machine Learning (ML) can help with identifying fraudulent activities.

MasterCard has been using AI to detect cyber attacks, hacks, and other types of security breaches. The AI-enabled-suite is called Cyber Secure, which allows banking institutions to assess and evaluate potential cyber security risks across their ecosystem.

How can banks successfully adopt AI?

While many banks are experimenting with AI and ML, only 8% of business decision-makers consider their companies’ ML programs sophisticated. Despite the wide adoption of AI, not every organization has successfully adopted it.

As mentioned earlier, the cost is the biggest, but it’s not the only hurdle to AI adoption in banks. On the path of adopting AI into business strategy, banks will also encounter technical barriers such as:

- Inadequate data quality and data management process

- Replacing or re-platforming legacy infrastructure to avoid disrupting core systems

- Assembling and configuring new cloud infrastructure to support algorithm testing and deployment

- Lack of human resources on AI

According to an article by Towards Data Science, there are four areas that banks need to address to adopt AI in banking. They are:

- Data governance and management platform

- IT governance framework and architecture optimization

- Cloud computing and cloud GPUs

- MLOps

We will go through these areas briefly to explore what banks need to prepare for AI adoption.

Data governance and management platform

Implementing AI would be much more effective with a data management platform to consolidate all internal and external data. The better your data management, the better result you can get from AI.

Besides having a good data management platform, it is equally vital for banks to invest time and resources into:

- Data cleaning to avoid the cost of adjusting poor data

- Data integration to shift the AI workloads to a cloud environment

- Building a data governance framework to prepare for later initiatives

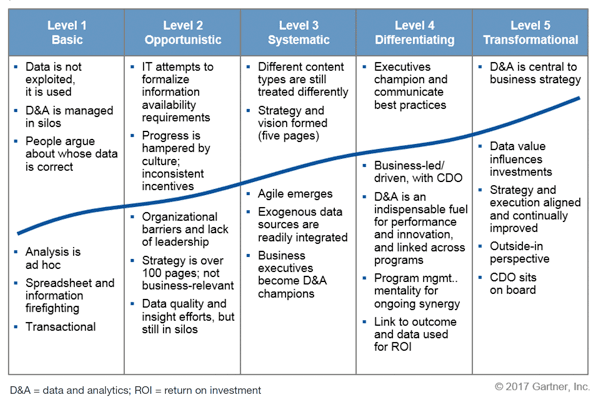

Without proper data governance, AI projects can suffer from more profound issues that could emerge later. To better understand whether an organization’s data is AI-ready, consider this data maturity model by Gartner.

Most businesses today are on level 1, and very few companies are in level 5. However, at level 3, businesses can already adopt machine learning into their day-to-day operations. At level 4, the ML infrastructure should be in place, and at level 5, companies can use ML pervasively.

IT governance framework and architecture optimization

A bank running on legacy systems would find it impossible to start implementing AI as it is old and rigid, with no space for new elements.

Meanwhile, a cloud-based platform would allow higher scalability and resilience for AI implementation. Cloud-based infrastructure also reduces IT maintenance costs and enables self-serve models for development teams.

However, it doesn’t mean that you need to replace everything in one go. The infographic below shows the three stages of legacy modernizing for banking.

Consider modernization as a part of the IT governance process. Therefore, IT leaders will need to have a road map for modernization and evolve one element at a time.

Cloud computing and cloud GPUs

As AI algorithms keep developing, computing powers are required to follow suit. According to Open AI, the computing power needed for training the largest AI models has doubled by a rate of every 3.4 months since 2012. Hence, there is an exponential increase in demand for AI hardware.

A report by Cambridge network specified two areas that need an increase in computing power to enable AI to progress. The first is GPUs which are for investment banks to undertake machine learning. The second is increasing the specification of personal computing devices that provide local information processing and AI model implementation without relying on a cloud server.

Banks can choose between investing in hardware or pay for cloud computing services like AWS, Google Cloud, and Microsoft Azure.

MLOps

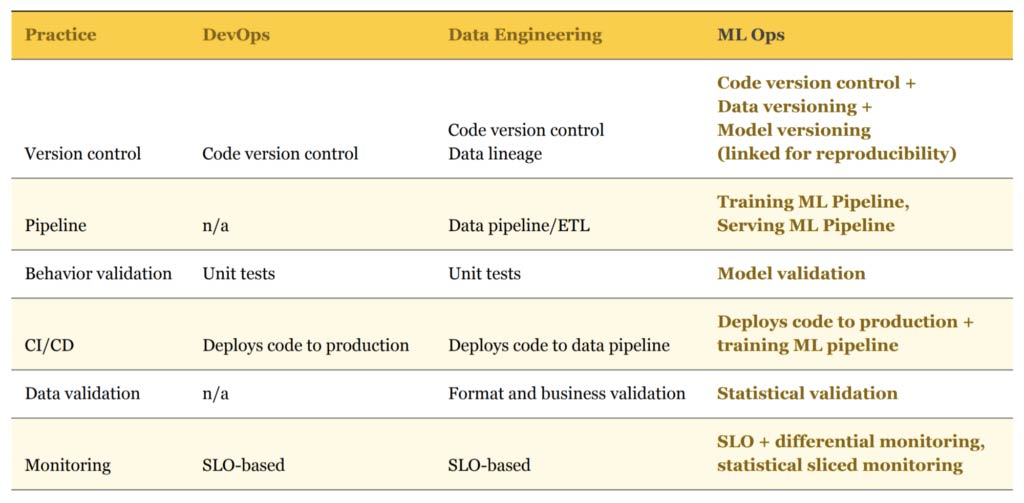

MLOps is a set of practices that combines Machine Learning (ML), DevOps, and Data Engineering. The following table summarizes MLOps’ primary practices and how they relate to DevOps and Data Engineering to understand the definition better.

According to Google Cloud, MLOps aims to help adopt and automate continuous integration (CI), continuous delivery (CD), and continuous training (CT) for ML models.

With MLOps, banks can save time on building a new AI project by

- Reusing pipelines and workflows for models

- Improving data integration and unify data governance

- Automating model set up, training, and testing

- Replicating with one-click and automated version control

- Enabling hotkey access to all resources for the project

And that’s how the ML team can immediately get to work on new AI projects, run experiments faster at a lower cost and with fewer risks.

In retrospect, we can conclude that:

- AI’s adoption rate in banking is increasing as competition is driving digital transformation throughout the industry. Despite the COVID-19 pandemic, AI is still a fundamental piece in banks’ roadmap to digital transformation.

- Major applications of AI in banking are (1) improving customer experience, (2) credit and loan decisions, (3) preventing frauds, (4) automating investment, and (5) regulatory compliance.

- Banks need to overcome barriers to adopt AI successfully. These barriers are cost, IT infrastructure, data quality, human resources, and management buy-in. Getting these pieces in place would ensure a successful implementation of AI and give banks the chance to get ahead in the competition.

Why choose GEM as your AI developer in Vietnam?

1. GEM Corporation is an IT Outsourcing company experienced with developing AI solutions. We have developed NLP and OCR solutions for top industrial corporations in Japan, specializing in deploying chatbots, text and image processors, and recommendation systems. We are also partnering with Vietnam National University’s AI Laboratory on scientific research and talent training.

2. Our domain expertise includes Logistics, Telecommunications, Finance, Banking and Insurance, Retails, Manufacturing, and so on.

3. We have more than seven years of experience. Our offices are in Hanoi, Vietnam, and Tokyo, Japan.

4. We have successfully built more than 100 successful projects for our clients in the US, UK, Europe, Japan, Korea, Singapore, and many more.

5. Let us know how we can help you build your next AI solution. Contact us now and get a demo for your project.

This article was originally posted on 7 February 2021 and updated on 14 October 2021 for more in-depth and relevance.