Contents

Robo-advisors, or AI-powered financial services, are changing the whole industry with their exceptional performance in simplifying and automating procedures, as well as analyzing and processing data.

Financial advisory has always been seen as a high-risk and challenging profession. As a result, advisors are constantly seeking new methods to minimize the risks while maximizing the opportunities. Artificial intelligence (AI) has emerged as a fascinating solution in this context, allowing individuals and businesses to achieve greater efficiency and unlock new possibilities. It comes with a variety of advantages, from real-time monitoring to increased compliance.

1. Financial advisory industry at a glance

Financial Advisory, or financial consulting, is a growing industry. In 2020, the global Financial Advisory market was estimated at US$82.3 billion and expected to expand to US$124.4 billion by 2027, rising at a CAGR of 6.1% between 2020 and 2027. This is driven by the increasing demand for crisis and turnaround management during the economic downturn by the COVID-19 pandemic. Besides, the M&A market has returned significantly, generating demand for corporate finance and transaction services.

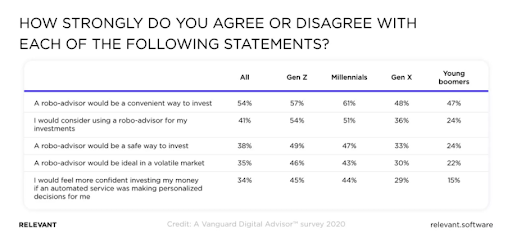

As the financial advisory industry is gaining attention, it requires extra efforts from advisors to both meet the rising demand and conduct the job efficiently. Based on the forecast of Investopedia, technological applications, among which are machine learning and Artificial Intelligence (AI), can be the key. In fact, AI may allow financial institutions to extend client connections, provide better advice, and save expenses. AI is proving its role in the industry by gaining increasing favorability from customers, especially from Millenials and Gen Z, with its most well-known application – Robo advisory. According to a survey by Vanguard, more than half of all customers acknowledged the convenience of Robo advisors, and a great number trust them for investments.

The core value of AI solutions lies in methodical data analysis, pattern generalization, and accumulative learning. These abilities allow AI to assist financial advisors in a variety of tasks such as administration, customer service, portfolio management, market prediction and forecast, and trading decisions.

2. AI and its potential to Financial Advisors

Automate administrative task

The combination of AI and RPA (robotic process automation) may be of great help in managing dull and repetitive procedures, allowing employees to focus on higher-value tasks. RPA is defined as the programming of robots to standardize and automate repetitive business processes. In a nutshell, RPA relies on structured inputs and logic, whereas AI relies on unstructured inputs and creates its own reasoning (thanks to its self-learning ability). As a result, AI and RPA can easily execute activities involving both structured (e.g., form fields) and unstructured data (e.g., free text, natural voice), such as onboarding.

One effective application of AI & RPA in simplifying the onboarding process is Wealthfront’s mobile app. Their new user onboarding is in the form of a progressive questionnaire that clearly asks clients about their objectives. Then, they will ask customers to connect their bank accounts and select modest goals, further personalizing the onboarding experience. A list of portfolio allocation ideas and an analysis of investment results fill out the experience.

Enhance customer service

Many clients’ questions are likely to be answered by an AI-driven assistant guided by a set of criteria. This virtual assistant might analyze the client’s inquiry and present financial advisors with some suggested solutions to consider and discuss.

This system might be set up to analyze the client’s financial condition on a regular basis, presenting choices as the client’s situation changes. Perhaps they have a loan that might be refinanced, or a recent change in the tax legislation would automatically cause the system to examine the impact on all clients.

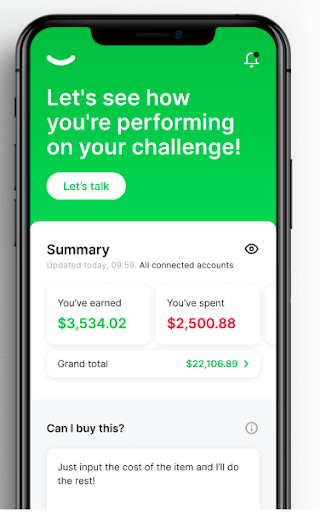

Olivia is a notable AI use case in financial advisory. She is a conversational assistant powered by machine learning techniques, connecting to a user’s bank accounts and offering real-time cost information. Olivia analyzes expenditure patterns and makes recommendations based on her findings. Olivia is simple to get along with because of her natural language ability.

Similarly, suppose the management of a mutual fund employed in one or more client portfolios changed significantly. In that case, the AI-based assistant may send an alert to the advisor, prompting him or her to decide whether the fund should be kept or replaced.

Finance chatbots: Top Benefits, Features and Use Cases

Better manage clients’ portfolios

Robo-advisors can build optimum portfolios based on the preferences of investors using a variation of Modern Portfolio Theory (MPT), which focuses on allocating assets with the goal of maximizing total returns while maintaining a manageable degree of risk. Advisors may develop goals-based advice solutions suited to each client’s needs by building AI-powered portfolio monitoring and reporting systems that enable automatic risk evaluations, suitability evaluations, pre-trade checks, and investment possibilities analysis. As economic conditions change, AI may suggest modifications in the weights of risky and risk-free assets to rebalance the portfolio.

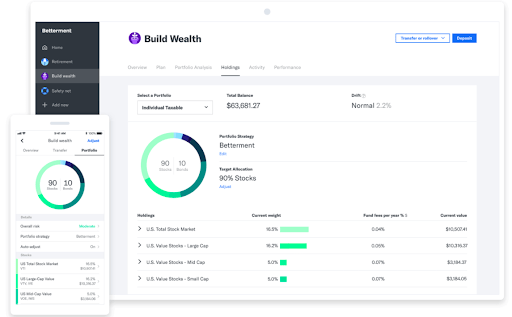

For example, Betterment offers smart portfolio management tools, including advisor-driven/ pre-built portfolio solutions and automated money management tools, which all contribute to more promising investment outcomes.

Assist in forecasting and planning

Thanks to its algorithms, AI can collect, analyze, and generalize data into patterns, making predictions that help financial advisors give suggestions to clients. This ability of AI is normally referred to as “prescriptive and predictive analytics,” by which AI anticipates and controls outcomes to reach the best one possible. Indeed, AI can power financial counseling products that adjust spending patterns based on lifestyle factors. Similarly, it can serve as a north star for intraday traders who want to time the market and decide whether to wait, build their position, or exit based on their risk appetite, opening, and closing prices, profit/loss potential, etc.

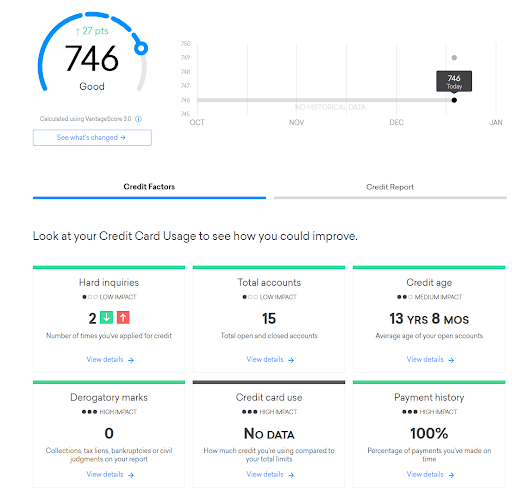

Credit Karma, for example, collects over 2,600 distinct data parameters per user to provide near-real-time individualized guidance. Its proprietary algorithm creates over 8 billion predictions on the best approach for a single client based on their goals.

Facilitate trading tasks

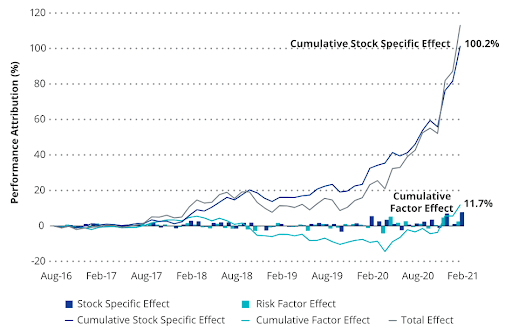

The examination of news reactions can aid in predicting stock market events and making better investing decisions. This is supported by the sentiment analysis of NLP (Natural Language Processing) technology. In a nutshell, sentiment analysis evaluates and categorizes emotions found in many types of text data (news stories, reports, and any other type of online textual information). For instance, if the program identifies unfavorable sentiments about a firm, it may forecast a drop in its stock price (and vice versa). Learning from the ideas and thoughts of many investors, corporate leaders, and other stock market participants on social media and blogs may help advisors give out smarter recommendations.

One significant example of this tool is a social media sentiment exchange-traded fund (ETF) developed by a New York-based financial management firm called VanEck. The tool collects and generalizes social inputs into financial ones, based on which suggests the next steps accordingly.

3. Conclusion

Undeniably, the financial advisory industry is a hotbed of AI-driven technical advancement. Companies may use AI technologies to investigate numerous business factors, develop accurate projections, improve real-time decision-making, and boost ROI. Versatile as it seems, AI may not replace human advisors in the time to come. Indeed, human connections are still one important factor in the industry as emotional responses and interactions still give customers a higher level of assurance. The solution of the future, as Robo-advisor companies like Betterment and Vanguard have applied, is the mixture of two forms as hybrid models, which utilize the strengths of both human and digital services.

Make better decisions with AI

AI tools are getting increasingly competent at enhancing decision-making, optimizing operations, and delivering personalized client experiences.

Are you ready to embrace and integrate with a trusted IT partner of 100+ global clients across industries? Fill in the form below and let’s connect!