Contents

Finance chatbots are growing continuously due to convenience and effectiveness to both companies and customers. They are utilized not only to address questions but also to simplify processes and manage financial status.

Chatbots have been a rising trend in the Finance industry, with 87% of financial firms having or planning to adopt them. The hype comes from improved experience (to customers) and resource optimization (to businesses). The potential is more significant since chatbots constantly receive positive responses from customers. More and more people prefer utilizing chatbots to visit branches of financial firms to perform their tasks.

This article will provide a zoom-in of chatbots’ outstanding benefits, their key to efficiency and usage in banks, insurance firms, and fintech organizations.

How can chatbots help?

Chatbots can streamline corporate procedures in the financial sector and provide instant access to services that were previously only available through applications. Indeed, money transfers, transaction history checks, or financial planning, which used to be conducted on separate apps, now can work with a chatbot (compatible with numerous platforms from text messages, and Facebook Messenger to Internet websites). The most significant benefits that chatbot offers to banks and financial firms include:

- Customer experience enhancement: Finance chatbots can deliver highly personalized interactions as they actively learn from real-time dialogues and instantly access relevant customer data. The AI-powered chatbots can filter through mountains of data in seconds and get the needed information far faster than humans at any time of the day.

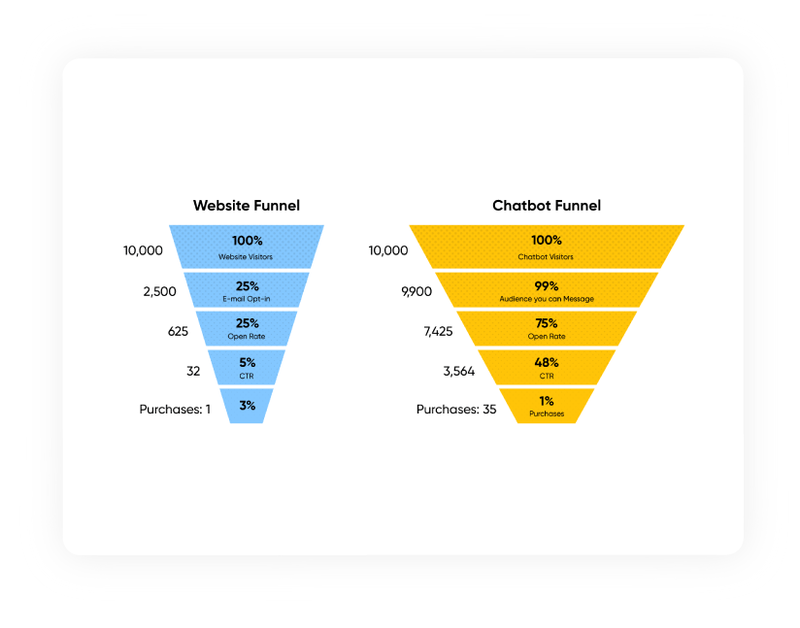

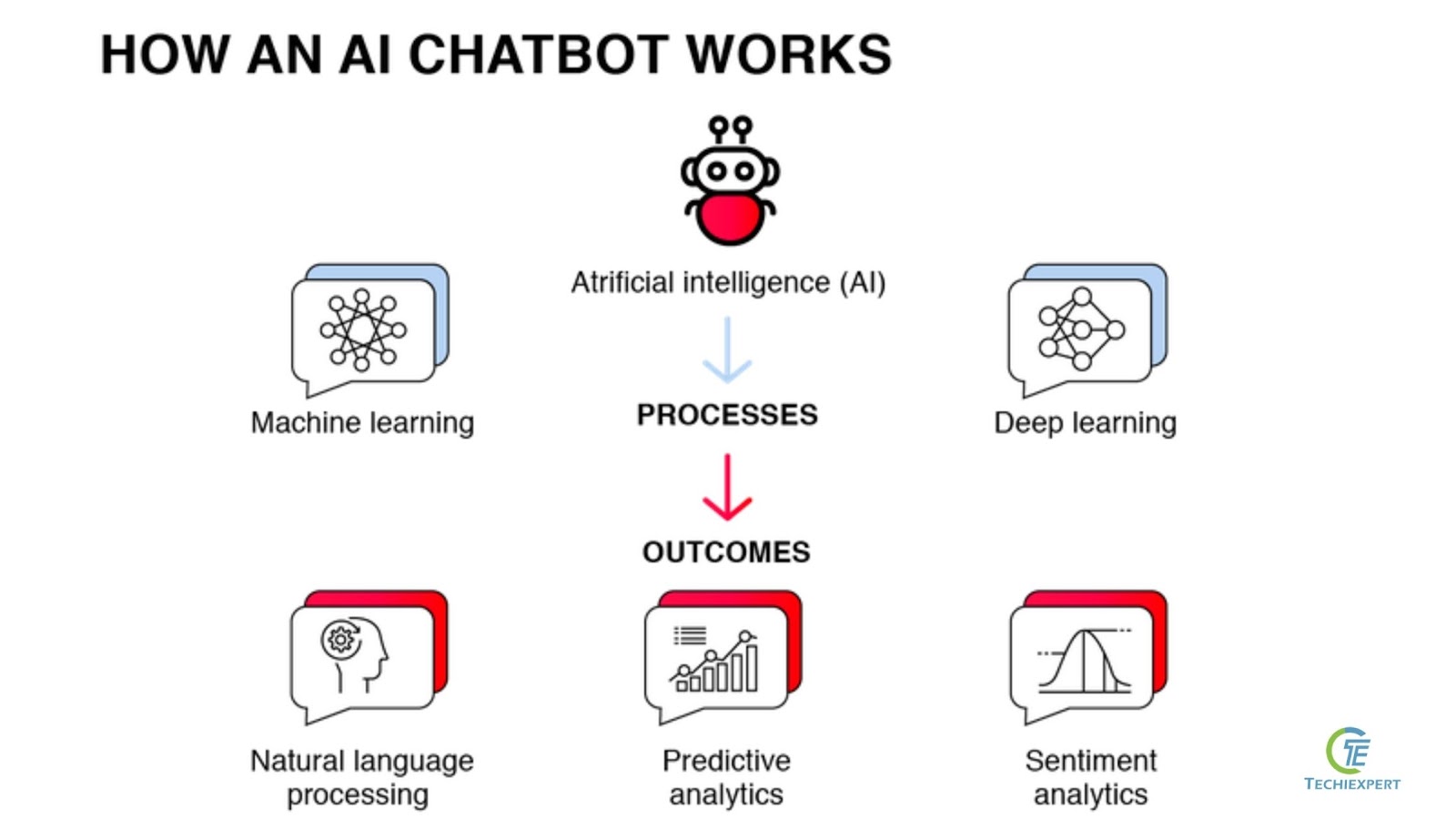

- Customer base expansion: Compared to traditional methods like emails or cold calls, companies have seen a 400% boost in the number of leads obtained utilizing chatbots. Chatbots produce quality leads and encourage conversion by integrating multiple types of AI, such as adequate semantic interpretation and understanding, machine learning, and natural language processing.

- Resource optimization: 80% of customer queries can be effectively resolved by a chatbot through an automated process, which may help businesses save operational costs and human resources, especially in the customer service team (up to $7.3 billion worldwide by 2023).

What makes a reliable and effective chatbot?

As chatbots become more intelligent and responsive thanks to continuous learning, they are expected to serve as financial consultants rather than FAQ chatbots. An effective chatbot should possess five key features:

- Omni-channel: For a seamless experience, the chatbots should be able to converse across numerous digital platforms (Social media, mobile apps, SMS, websites,…) while retaining users’ data and context.

- Continuous innovation: Thanks to machine learning algorithms, chatbots can review their performance and learn from previous sessions, therefore delivering better solutions based on individual context.

- Human-like interaction: By utilizing advances in natural language processing (NLP) – a subfield of machine learning, chatbots can comprehend context without asking validating questions,and adapt their tone of voice to be as natural as possible for each customer.

- Security: Privacy and data security are critical in finance. It’s critical that chatbots be integrated with a centralized authentication system and guarantee the privacy of the conversational data.

- Integration: One of the most important chatbot features is chatbot integration. This means working in tandem with existing technologies and even business knowledge, known as KSC (Knowledge-centered service).

Above all, companies should choose technology partners with a firm foundation and diverse experience in building chatbots to ensure their investment works.

8 use cases of chatbots in the finance industry

1. Virtual Assistant

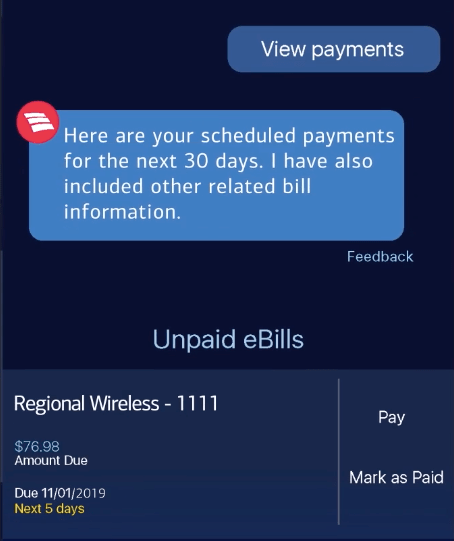

Chatbots can be developed in a virtual assistant who directly interacts with customers by handling their queries and complaints. Take Erica, for example. It is a chatbot released by Bank of America to assist consumers in locating and tracking transactions and managing banking tasks such as balance inquiries, bill payments, cash transfers, and finance reports. Erica also provides information about customers’ credit ratings and spending habits.

2. Financial Advisor

The ability of chatbots extends well beyond just responding to all client inquiries. They are powerful enough to advise individuals on their financial health and guide them through making a sound decision on an investment or saving plan. AI-powered financial services chatbots can provide credible suggestions based on user spending behavior and account tracking.

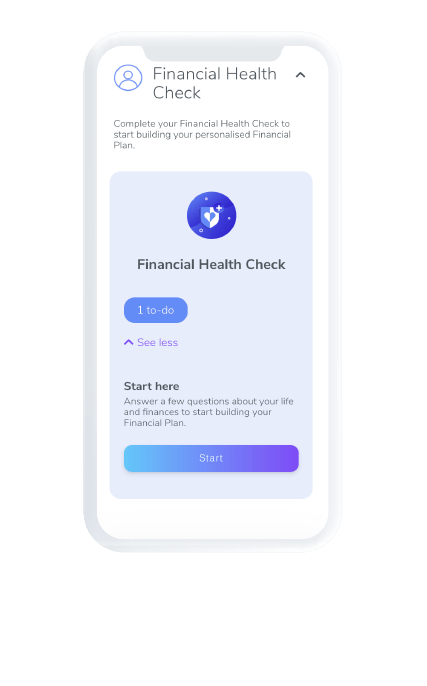

MyEva chatbot is a product of the digital advising business – Wealth Wizards, which offers customers financial health checks service. Anyone in need of financial assistance can contact it and receive helpful advice depending on their position and economic history.

3. Wealth Management

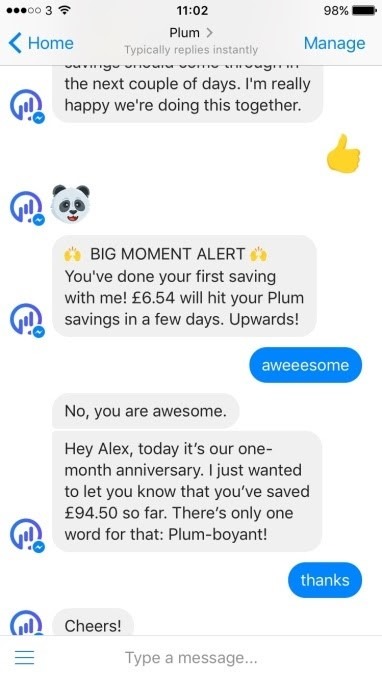

One of the most popular applications of chatbots in Fintech is finance management. Personal money chatbots may help customers get hold of their financial status over time and facilitate saving plans. One popular chatbot-based application for wealth management is Plum, which is described as the first AI-powered Facebook chatbot that allows users to start saving small sums of money quickly.

As Plum is linked to a user’s bank account, it would learn their spending and saving habits. Plum’s algorithm calculates what users can safely set aside without affecting their daily lives and automatically deposits a frequent sum of money into users’ Plum savings accounts every few days.

The deposit may change each time based on users’ actual financial performance. Besides, there are other saving modes like Weekly Saver, Rainy Days, and Paydays, where users may hold a fixed amount occasionally (each week, on rainy days, on salary days, etc.)

4. Instant Loan Approval

Finance chatbots have simplified the time-consuming procedure of loan acceptance. The BFSI sector has leveraged financial services chatbots to provide consumers with the speedy loan approval. By providing instant answers to FAQs on loan applications, bots assist customers in understanding the procedure and applying within a few messages. The chatbot will automatically check customers’ credit status, then the loan is approved, and the funds are credited instantly.

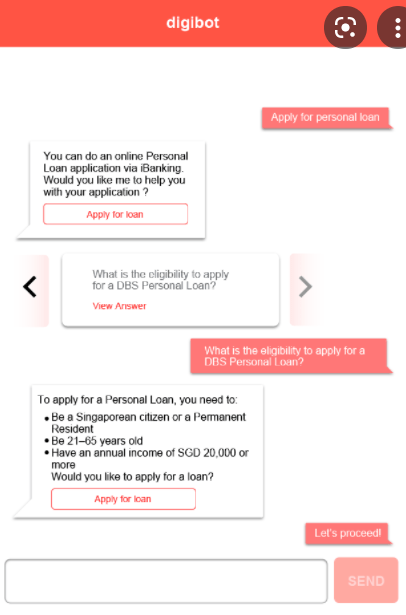

For instance, Singapore Bank DBS created a digit to make it easier for clients to check out products and services. The bot is handy when consumers request loans since it allows for rapid approval.

5. Insurance Claim Settlement

The entire settlement procedure tends to be time-consuming, and clients frequently have to wait longer than they would like for their claims to be granted. However, with the introduction of AI-powered financial chatbots, insurance companies can now resolve claims more quickly.

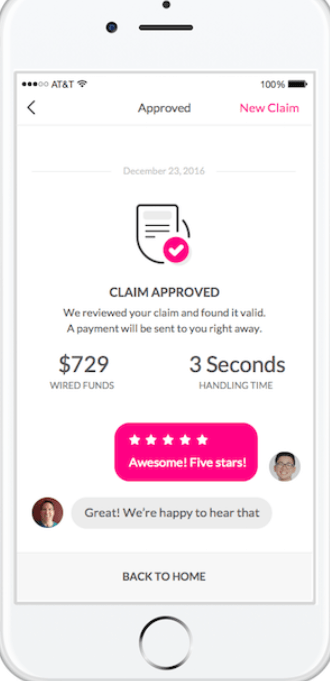

A finance chatbot built by Lemonade, a New York-based insurance start-up, set a new record by settling a basic insurance claim in only 3 seconds. Naturally, the corporation can obtain pleased clients and significantly reduce expenses.

6. Tax Assistance

Given the complexities involved with taxes, customers usually require some support. This is where AI-enabled financial services chatbots may make an impact. Bots may aid clients by answering all of their tax-related questions and providing support through a step-by-step tutorial to make the entire procedure easier.

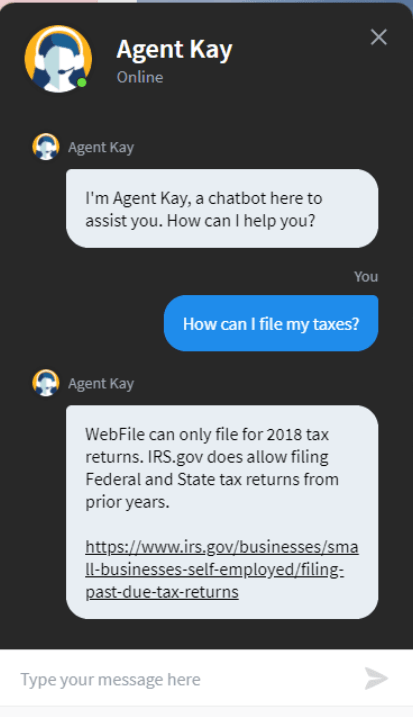

Kansas is the first state in the United States to use an AI chatbot, Agent Kay, to answer all tax-related queries from clients. The bot is linked to the state’s full-service online tax filing site and is available 24 hours a day, seven days a week.

7. Mortgage Facilitation

The loan demand for property acquisition or housing renovation has never decreased. However, customers seem to be constantly lacking information about the process, terms and conditions, regulations, etc. Conversational AI chatbots may readily fill this hole by answering questions about house loans of any type or size.

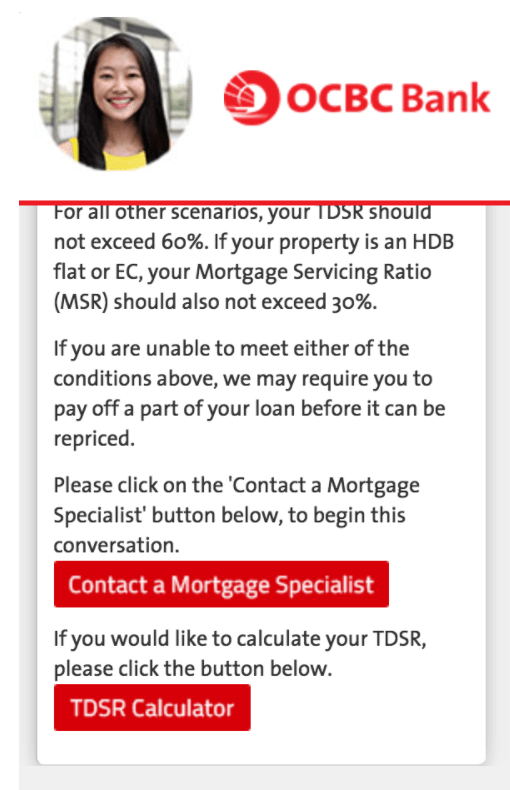

Among finance chatbot examples, EMMA, a first-of-its-kind home and renovation loan chatbot has been introduced by OCBC Bank to address client concerns through a dedicated channel. This finance chatbots can calculate borrowers’ aptitude and provide recommendations similar to a mortgage consultant.

8. Fraud Detection

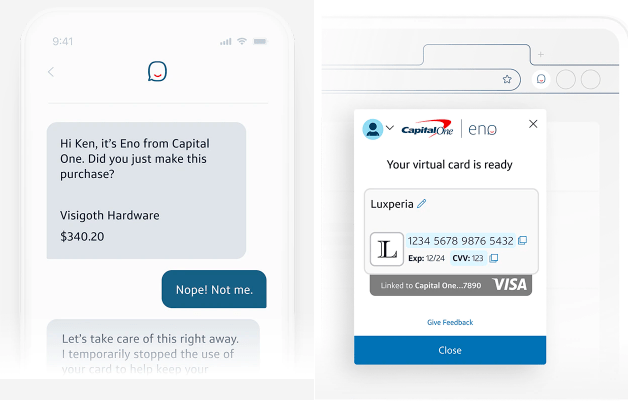

Basically, finance chatbots can remember customers’ financial activities and generalize them into patterns (For example, monthly spending on bills, fees, or regular incomes like salary). Hence, bots can immediately alert customers and suggest needed security support in case of suspicious transactions. More advanced, they record sessions/ conversations, utilize natural language understanding (NLU) to detect fraudulent or suspect conduct, then inform live agents to take action. Data generated from chatbots may also be used to detect fraudulent patterns and train and update chatbots’ knowledge.

A well-functioning finance chatbot in fraud detection is Eno by Capital One, which employs AI to assist clients with banking operations. Aside from facilitating basic processes like card activation, payments, and account balance checks, the bot constantly checks for unusual spending (even duplicate charges) and allows e-Visa cards to protect customers’ credit accounts from fraud better.

Conclusion

In a digital age, the utilization of finance chatbots is facilitated by technological development (AI & machine learning). It will keep growing for convenience and optimization to both customers and organizations. Finance chatbots can bring their best if they are programmed compatible across platforms, customer-centric, and secure. From traditional services to emerging Fintech, finance chatbots set no limit to their applications.

Are you ready to thrive in the finance domain?

Get started with an outstanding Vietnam-based IT firm that has in-depth experience in delivering advanced chatbot solutions.

Our 100+ projects have driven innovation and growth across different industries, including logistics, telecommunications, retail, manufacturing, banking and finance, and so many more.

Fill in the form below and let our team of experts give you a hand.