Contents

- The Payment App Market in 2025: What’s Driving the Change?

- Core Functions of a Modern Payment App

- Top 10 Payment Apps to Watch in 2025

- Apple Pay – Best Payment App for iOS Users

- Google Wallet – Best App for Android Users

- Cash App – Best for All-in-One Finance

- PayPal – Best for Global Online Payments

- Venmo – Best for Social Payments

- Zelle – Best for Instant Bank Transfers

- Wise – Best for Low-Cost International Transfers

- Stripe – Best for Online Businesses

- Revolut – Best for International Travelers

- Chime – Best for Fee-Free Banking

- How to Build a Payment App?

- How to Make the Most Out of Your Custom Mobile Payment App?

- Build Your Modern Payment App with GEM Corporation

- Takeaways

The global digital payments market is projected to reach over $11 trillion in 2025. This massive growth is driven by the rapid evolution of the modern payment app, transforming how we handle money. Today’s top apps are far more than just some wallet applications; they are becoming integrated financial tools that simplify transactions, offer spending insights, and provide new features like in-app investing. In this article, we’ll explore the key trends and spotlight the apps that are leading the charge in this new financial landscape.

The Payment App Market in 2025: What’s Driving the Change?

The digital payments scene is moving incredibly fast. What was once a simple way to transfer money has evolved into a central part of our daily lives. Several major shifts are making this happen.

The demand for a frictionless experience: People want to pay on an app easily with a single tap, scan, or click. Technologies like contactless payments and near-field communication (NFC) are now standard. This is not just for convenience; it’s about making transactions instant and seamless.

The growth of the “super-app” model: Payment apps are expanding their scope. They are becoming multi-service platforms that include everything from shopping and food delivery to ride-sharing and bill payment. This trend creates a one-stop digital hub for users.

Advanced security and personalization: AI is becoming central to payment app security. It detects fraudulent activity in real-time and personalizes the user experience with smart budgeting and spending insights. Biometric authentication, like face and fingerprint scans, is a standard method to secure accounts and authorize transactions.

The move to invisible payments: Payments are being embedded directly into different products and services. For example, some apps let you pay for a service without ever having to open a separate payment screen. This makes transactions feel effortless and natural.

Read more: See which in 15 fintech apps are defining the future of digital payments this year.

Core Functions of a Modern Payment App

Modern apps are now a hub for managing your financial life. The best ones meet both basic expectations for convenience and safety while also introducing smart, new tools.

Must-Have Features (The Basics)

These are the functions every user expects a reliable payment app to have.

- Peer-to-Peer (P2P) Payments: The ability to send and receive money to friends and family with a few taps. Payments happen instantly, with funds going directly into a connected account or the app’s digital balance.

- Contactless and In-Store Payments: A mobile phone becomes a digital card. Users can pay at physical locations by tapping their device at a terminal. This process is fast and secure, often using biometric verification like a fingerprint or face scan.

- Integrated Bill Pay: Users can manage and pay their bills directly inside the app. This feature brings together utilities, credit cards, and other recurring expenses in one place, streamlining the monthly payment process.

- Advanced Security: Modern apps protect user data with multiple layers. This includes tokenization, which replaces sensitive card details with unique codes, and real-time fraud detection systems that watch for unusual activity.

Next-Level Features (The Differentiators)

These functions separate the top apps from the rest by providing extra value and a richer user experience.

- International transfers: Sending money internationally is a standard function. These apps often provide competitive exchange rates and transparent fees, making it simple to support family or conduct business overseas.

- Rewards and Gamification: Some apps motivate users with rewards for certain actions, like saving a set amount of money or tracking a spending goal. This approach makes financial management feel more interactive.

- Integrated BNPL (Buy Now, Pay Later): The BNPL model is now part of the payment process. Users can split a purchase into multiple payments directly at checkout, making bigger buys more manageable without leaving the app.

- Personalized Spending Insights: Apps use data to categorize spending and present it with charts and graphs. This gives users a clear picture of their financial habits, which can help with budgeting and saving goals.

Read more: See how GEM creates mobile apps that make payments faster, safer, and more engaging for users.

Top 10 Payment Apps to Watch in 2025

The payment app landscape is full of innovation. From tech giants to disruptive fintechs, these ten apps are setting the pace for what a modern payment service can do.

Apple Pay – Best Payment App for iOS Users

Apple Pay is a secure and private payment service built directly into Apple devices. It transforms a user’s iPhone, Apple Watch, or Mac into a digital wallet for in-store, in-app, and online payments. The service is widely used, with over 624 million users globally in 2025. Its deep integration into the Apple ecosystem makes it a top choice for seamless transactions.

Benefits:

- Simple user experience and deep integration with Apple devices.

- Privacy is a priority, with no card numbers stored on the device.

Key features:

- Contactless payments via NFC.

- Secure in-app and web purchases.

- P2P transfers through iMessage.

Google Wallet – Best App for Android Users

Google Wallet is a versatile digital wallet for Android devices. The service is widely adopted, with 200-250 million active users globally in 2025. It stores and organizes more than just payment cards, including loyalty cards, tickets, and student IDs. Google Wallet provides a simple and fast checkout experience for the majority of the world’s smartphone users.

Benefits:

- Widespread acceptance at physical and online merchants.

- It gives users a single place to store various digital items.

Key features:

- Tap-to-pay functionality.

- Boarding pass and event ticket storage.

- Tight integration with other Google services.

Cash App – Best for All-in-One Finance

Cash App has moved beyond simple peer-to-peer payments. It is a full financial ecosystem that lets users handle money, invest in stocks, and trade Bitcoin. The app’s user base is approximately 58 million monthly active users in 2025. Its straightforward design and range of features make it a popular financial hub, especially among younger generations.

Benefits:

- A single app provides access to a range of financial services.

- The app has a simple and approachable design.

Key features:

- Instant P2P money transfers.

- A physical Cash Card for purchases.

- Fractional stock investing and Bitcoin trading.

Make your digital transformation seamless and future-ready Accelerate your business growth with zero-disruption modernization services. Maximize the value of your current infrastructure, streamline processes, and cut expenses.

PayPal – Best for Global Online Payments

PayPal remains a powerhouse in online payments, known for its buyer and seller protection. With over 434 million active user accounts as of Q1 2025, it is a global leader in the digital payment space. Its long history and comprehensive suite of services make it a trusted platform for transactions both big and small.

Benefits:

- Trusted by millions for secure online transactions.

- It is a reliable solution for cross-border e-commerce.

Key features:

- Payment protection.

- Credit and BNPL services.

- International transfers.

Venmo – Best for Social Payments

Venmo is a social payments app that makes sending and receiving money to friends feel like a community experience. The app’s user count is projected to reach over 83 million by 2025. Its signature public transaction feed sets it apart from traditional payment services. The app is a popular choice for splitting bills and managing group expenses.

Benefits:

Its social feed makes transactions feel more personal.

A favorite for splitting bills and sharing expenses.

Key features:

- P2P payments with social emojis.

- A Venmo Card for purchases.

- Direct deposit for paychecks.

Zelle – Best for Instant Bank Transfers

Zelle is a fast P2P payments service embedded directly within many U.S. banking apps. It is a collaboration between major financial institutions that has grown to over 82 million enrolled users in 2025. Money moves directly from bank account to bank account, typically in minutes. Since it is part of a bank’s app, there is no need for a separate download.

Benefits:

- Money moves directly from bank to bank, with no transaction fees.

- High level of trust due to its bank backing.

Key Features:

- Instant bank-to-bank transfers.

- Integration with over 2,000 financial institutions.

Wise – Best for Low-Cost International Transfers

Wise focuses on making international money transfers cheap, fast, and transparent. The service has grown to serve over 15.6 million active customers in the last 12 months. It operates by routing money through local bank accounts in different countries to avoid high conversion fees. It has established itself as the top choice for people and businesses that send money across borders.

Benefits:

- Saves users a significant amount on international transfers.

- Fees are clear and upfront.

Key Features:

- Multi-currency account.

- A debit card for international spending.

- A transfer service for over 80 countries.

Bring your ideas to life faster than ever before Our agile solutions streamline workflows and cut time-to-market, helping you launch innovations quickly and confidently.

Stripe – Best for Online Businesses

Stripe is a payment processing platform for online businesses. It provides the technical infrastructure for companies to accept and manage payments. The service is trusted by both small startups and major corporations for its reliability and security. It is used by over 4.2 million websites worldwide in 2025, which shows its market share on the merchant side.

Benefits:

- It provides the core infrastructure for businesses to accept payments.

- It is trusted by a wide range of businesses for its security.

Key Features:

- APIs for custom payment flows.

- Recurring billing for subscriptions.

- Advanced fraud prevention tools.

Revolut – Best for International Travelers

Revolut is a digital-first banking service that provides a range of financial products. It has grown to over 65 million customers, with continued growth expected in 2025. It is popular with international users and travelers because it simplifies money management with transparent fees and real-time exchange rates.

Benefits:

- Simplifies international money management with transparent fees.

- Gives users a unified platform for multiple financial needs.

Key Features:

- Multi-currency accounts.

- Instant transfers.

- Cryptocurrency trading and budgeting tools.

Chime – Best for Fee-Free Banking

Chime is a digital-first banking platform. It provides a spending account, a savings account, and a credit builder tool without monthly fees. It reported 8.6 million active members as of late 2024, with growth continuing into 2025. The app’s simple, no-fee experience makes banking more accessible for a modern audience.

Benefits:

- It is a no-fee banking service.

- It provides early access to direct deposits.

Key Features:

- Fee-free banking.

- Automatic savings tools.

- An overdraft protection feature.

Transform Your Business with the Power of Technology Adopt AI, cloud solutions, and advanced analytics to reimagine your operations and stay ahead of the competition. Let’s future-proof your business together.

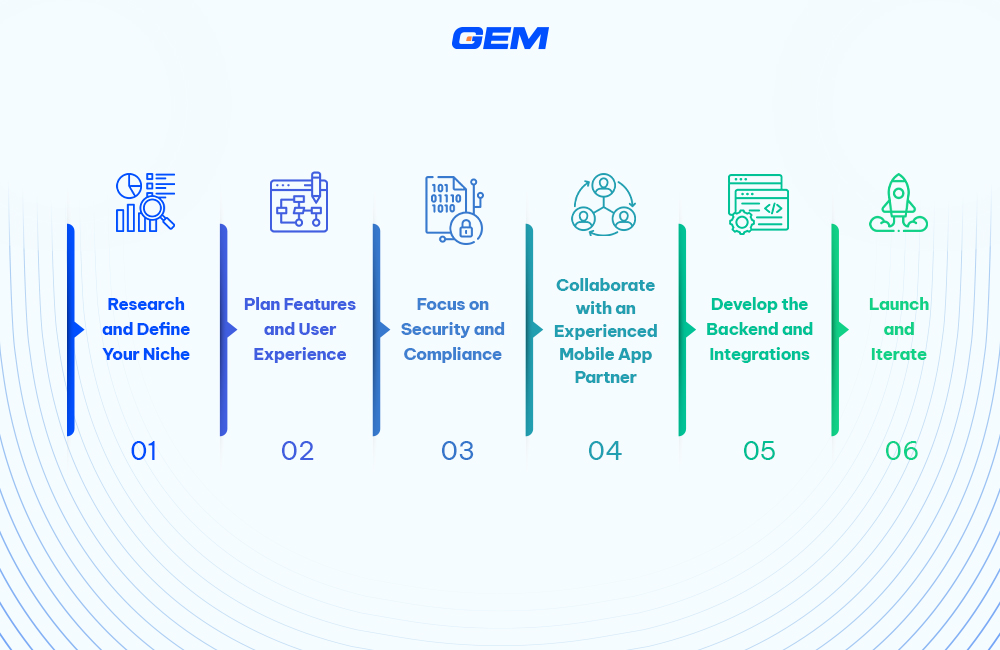

How to Build a Payment App?

Building a modern payment app is a complex project that goes beyond a simple user interface. It involves careful planning and a deep understanding of financial technology. The process requires a phased approach to manage security, compliance, and user experience.

Step 1: Research and Define Your Niche

Before writing any code, identify your target audience and the specific problem you want to solve. Is your app for peer-to-peer transfers, business payments, or a specific community? A clear niche helps you stand out in a crowded market.

Step 2: Plan Features and User Experience

Create a detailed plan for your app’s functions. The user interface should be simple and easy to use. Prioritize core features first, like P2P transfers and secure sign-in. Then, think about next-level features that make your app unique, such as personalized insights or a loyalty program.

Step 3: Focus on Security and Compliance

Financial apps handle sensitive data, so security is paramount. You must meet strict regulatory standards like PCI DSS 4.0, KYC (Know Your Customer), and AML (Anti-Money Laundering). This involves using strong encryption, biometric authentication, and building a robust fraud detection system.

Step 4: Collaborate with an Experienced Mobile App Partner

A professional mobile app development company with experience in the fintech industry is a key partner. They have a team that understands the complex financial regulations, secure coding practices, and integrations required for a successful launch. Their expertise minimizes risks and gets your app to market faster.

Step 5: Develop the Backend and Integrations

A strong backend is the engine of your app. It processes transactions, manages user data, and connects to other services. You will need to integrate with payment gateways, banking APIs, and other financial services to handle transactions smoothly and securely.

Step 6: Launch and Iterate

Your first version is just the beginning. After you launch, collect user feedback and monitor your app’s performance. Use this information to fix bugs and plan future updates. A strategy for ongoing improvements will keep your app relevant and user-focused.

Why Wait? Start Your Digital Transformation Today Don’t let outdated systems hold you back. With our expertise, you can streamline your operations, embrace innovation, and see measurable results faster than ever

How to Make the Most Out of Your Custom Mobile Payment App?

As the payment ecosystem continues to shift toward embedded finance, open banking, and AI-driven personalization, custom mobile payment apps must do more than process transactions. To compete with the top modern players in 2025, businesses should focus on four strategic areas:

- Align the App with Specific Use Cases

Generic payment functionality no longer sets an app apart. Custom apps should reflect the nuances of your business model, whether that’s integrating loyalty programs, supporting multi-currency payments, or streamlining B2B invoicing. The most valuable features are those that map directly to user behavior and business workflows.

- Invest in Scalability and Security from the Start

As digital wallets and real-time payments gain traction, transaction volumes and security expectations are rising. Cloud-native architecture, tokenization, and compliance with evolving standards like PSD3 or ISO 20022 should be considered early in the development cycle to avoid costly rework.

- Prioritize Data Integration and Analytics

Payment data is a source of insight. By integrating the app with CRM, ERP, or inventory systems, businesses can surface purchase patterns, track user engagement, and personalize offers. Built-in analytics also help identify friction points that slow down the checkout experience.

- Design for Interoperability

In an ecosystem where users switch between multiple platforms, your payment app should integrate easily with other digital services – QR code scanning, POS hardware, buy-now-pay-later (BNPL) engines, or even industry-specific platforms like ride-hailing or food delivery. API-first development ensures long-term flexibility.

- Monitor Adoption and Continuously Iterate

Launching the app is not the finish line. Tracking metrics like active users, transaction success rates, and feature usage helps identify areas for refinement. A roadmap that includes regular updates based on user feedback and emerging market trends keeps the app competitive.

Read more: Discover how GEM’s Cloud-Native Development services help build secure, scalable, and high-performance mobile payment apps.

Build Your Modern Payment App with GEM Corporation

GEM Corporation is a global IT service and consulting company, serving international markets, including Japan, Korea, ANZ, EU and the US. With over 400 engineers and more than 300 successful projects across 10+ countries, GEM works with enterprise clients and mid-sized firms to deliver tailored digital solutions across sectors. The company offers a comprehensive service portfolio – digital strategy consulting, application development, and quality assurance to cloud services, AI solutions, and data engineering.

GEM’s expertise lies in building secure payment apps with modern technology. We focus on using emerging technologies like AI for fraud detection and biometrics for security. Our team also put a strong emphasis on scalable backend systems and rigorous quality assurance and testing to meet financial compliance standards.

Our commitment to performance and innovation has been recognized globally. GEM was named the Gold Winner – Top IT Service Provider of the Year at the 2025 Globee® Technology Awards and is listed among the Top IT Service Companies in Vietnam by Clutch. With continued investment in emerging technologies and a track record of long-term client relationships, GEM is positioned as a strategic partner for digital transformation projects.

Takeaways

The modern payment apps of 2025 are shaping a future where transactions are not just instant, but also secure and highly personalized. We’ve seen how the market is moving toward frictionless experiences and all-in-one “super-apps.” From the rise of biometrics to the sophistication of AI-powered fraud detection, technology is making finance more intuitive than ever. These trends show that building a successful app today requires more than a simple wallet. It requires a forward-looking approach to security and user experience.

To start your project, contact GEM Corporation and bring your vision to life!

What defines a modern payment app in today’s market?

Modern payment apps go beyond basic transfers. They often include digital wallets, peer-to-peer payments, budgeting tools, and integration with financial services like lending or crypto. Real-time processing, multi-platform support, and data-driven personalization are becoming baseline expectations.

Why are apps like Apple Pay and Google Wallet still relevant in 2025?

Apple Pay and Google Wallet maintain relevance through native integration with their respective operating systems, strong security frameworks, and broad merchant acceptance. Their role in digital ID, transit, and loyalty programs continues to expand, keeping them central to mobile-first financial activity.

What makes Stripe and Wise stand out among business users and international consumers?

Stripe offers robust APIs and developer tools, making it a go-to for online businesses looking to scale payments globally. Wise differentiates through transparent currency conversion and low transfer fees, appealing to freelancers, SMEs, and frequent travelers managing international payments.

What should businesses consider when building a custom mobile payment app?

Key considerations include aligning features with user behavior, building scalable and secure infrastructure, ensuring interoperability through APIs, and embedding analytics for continuous improvement. The goal is to deliver a payment experience that’s both seamless and strategically tied to business operations.