Contents

Running a small business involves many responsibilities, and managing finances is one of the most important. With over 64% of small businesses now using accounting software, it is a key tool for financial stability. These digital solutions automate complex tasks, from tracking expenses to generating reports, freeing up time for growth. Choosing the right platform can directly impact your company’s efficiency and financial health. This guide will provide a rundown of the top 10 bookkeeping software to consider for your business.

The Importance of Bookkeeping Software

Small business owners often handle multiple roles, and managing finances without the right tools can be time-consuming and prone to error. Bookkeeping software provides a solution by automating key processes, giving owners a clear picture of their financial health, and simplifying a variety of tasks that were once handled manually.

The benefits of using this software extend beyond simple record-keeping:

- Time Savings: Automation of repetitive tasks like invoicing, data entry, and bank reconciliation frees up many hours each week.

- Greater Accuracy: Automated calculations and data import from bank accounts reduce the chance of human error. This makes for a more reliable financial record.

- Clear Financial Insight: A real-time dashboard and customizable reports give a clear view of income, spending, and profitability.

- Simplified Tax Preparation: The software organizes and categorizes all transactions, which simplifies filing and helps avoid errors during tax season.

- Data Security: Cloud-based systems come with security measures like data encryption and automated backups, which protect sensitive financial information from loss or unauthorized access.

Top 10 Bookkeeping Software for SMEs

QuickBooks

QuickBooks is a market leader and a go-to choice for many small businesses. It is a powerful accounting software with a wide range of functions. The platform is known for its user-friendly interface and a large ecosystem of tools and add-ons. Its long-standing reputation and a user base of millions make it a standard for many new businesses seeking a reliable accounting system.

Key Features:

- AI-powered expense categorization.

- Automated bank and credit card reconciliation.

- In-depth financial reporting, including P&L and balance sheets.

- Payroll management and tax preparation.

- Inventory management.

Xero

Xero is a popular cloud-based platform for small businesses and accountants. It is recognized for its intuitive design and collaboration features. Xero is often considered a top accounting software for small businesses because it provides unlimited users on all plans, which is perfect for teams that need to work together on their finances. Its extensive list of integrations makes it a flexible choice.

Key Features:

- Unlimited users.

- Automated bank feeds.

- Over 1,000 third-party app integrations.

- Multi-currency support.

- Invoicing with automated reminders.

Zoho Books

Zoho Books is a comprehensive online accounting solution that is a part of the larger Zoho suite of business tools. The software is known for its strong automation features, which cut down on manual data entry and repetitive tasks. It is a solid option for businesses that want a balance of features and affordability. Many reviews compare small business accounting software and find Zoho’s automation a standout feature.

Key Features:

- Workflow and payment automation.

- Integrated inventory management.

- Time tracking and project billing.

- Client portal for invoices and payments.

- Mobile app for on-the-go finance management.

Sage Business Cloud Accounting

Sage Business Cloud Accounting is a cloud-based solution that fits the needs of a wide range of SMEs. It provides robust financial management capabilities, from invoicing to reporting. The platform has a reputation for its security and accurate financial data processing. Sage is a strong contender for businesses that require detailed tracking and a dependable system.

Key Features:

- Real-time cash flow monitoring.

- Detailed reporting.

- Inventory and project tracking.

- Sales tax compliance.

- Invoicing and expense management.

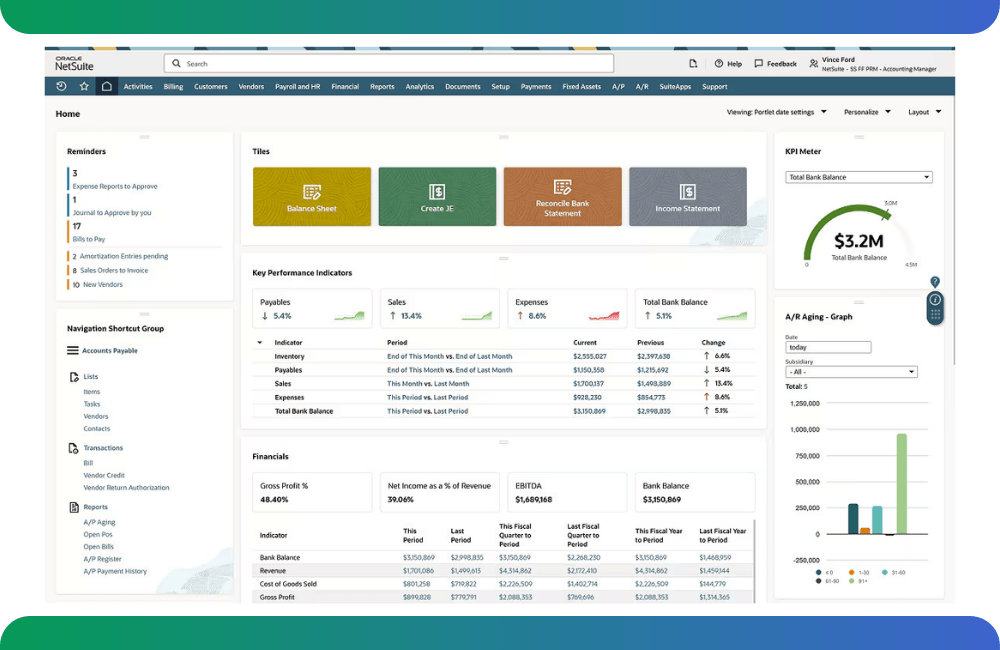

NetSuite

NetSuite is a cloud-based business management software with powerful accounting capabilities at its core. While it is more of a complete ERP solution than a simple bookkeeping tool, its scalability makes it a fit for growing SMEs. It is often regarded as a best accounting system for businesses that plan for rapid expansion and require a comprehensive view of their operations.

Key Features:

- End-to-end ERP functionality.

- Real-time reporting and dashboards.

- AI-driven automation.

- Built-in payroll and inventory management.

- Advanced analytics and forecasting.

Odoo Accounting

Odoo Accounting is part of a larger, modular suite of business applications. It is an open-source solution with a dedicated accounting module that simplifies daily financial tasks. This platform is ideal for a growing company that wants to add more functions, such as inventory or sales management, as they expand. Odoo provides a single, integrated platform for a business’s operational needs.

Key Features:

- Full integration with other Odoo apps.

- Automated bank reconciliation.

- Multi-currency and multi-company support.

- Real-time reporting and financial dashboards.

- Advanced features like tax suggestions and fixed asset management.

FreshBooks

FreshBooks is a well-known accounting solution designed for freelancers and small service-based businesses. Its core strength lies in its simple design and focus on making invoicing and time tracking straightforward. This platform gets a lot of praise from users for its clean interface and client management tools. For many, it is the best accounting software for a small business that bills for time or projects.

Key Features:

- Professional invoicing with online payment options.

- Time tracking and project management.

- Automated expense capture with receipt scanning.

- Late payment reminders and automatic recurring billing.

- Mobile app for managing finances on the go.

Sage 50 Accounting

Sage 50 Accounting is a desktop-first solution with cloud connectivity. It provides robust tools for managing cash flow, inventory, and job costs. The platform is suitable for businesses that have more complex accounting needs and want a secure, traditional desktop solution. Its advanced reporting and detailed project tracking features make it a powerful choice.

Key Features:

- Advanced inventory and job costing.

- Serialized inventory tracking.

- Detailed financial analysis and over 150 customizable reports.

- Advanced budgeting and forecasting tools.

- Remote access to data via the cloud.

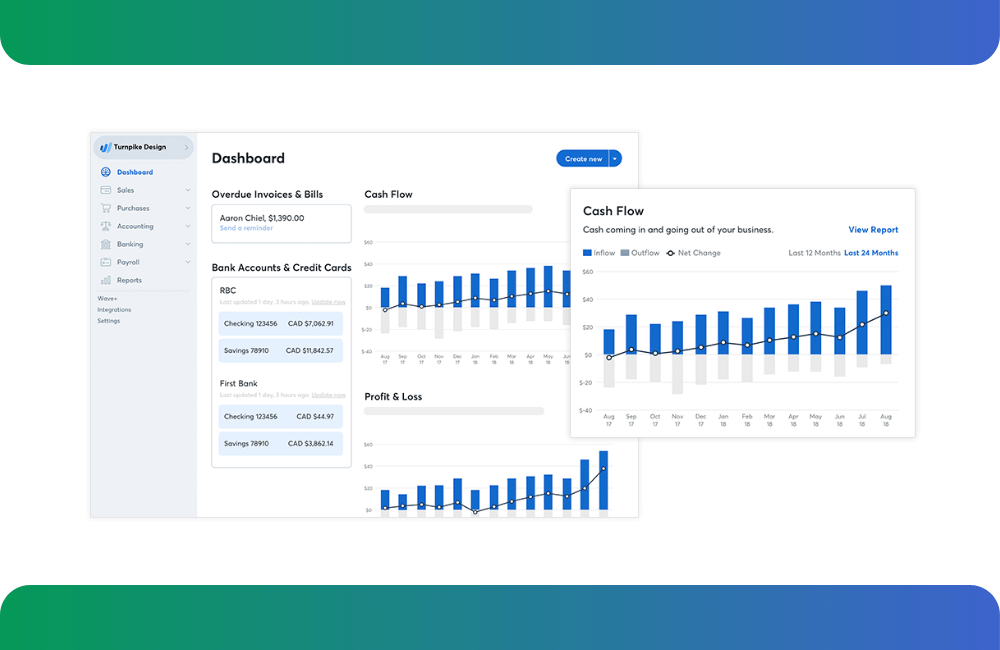

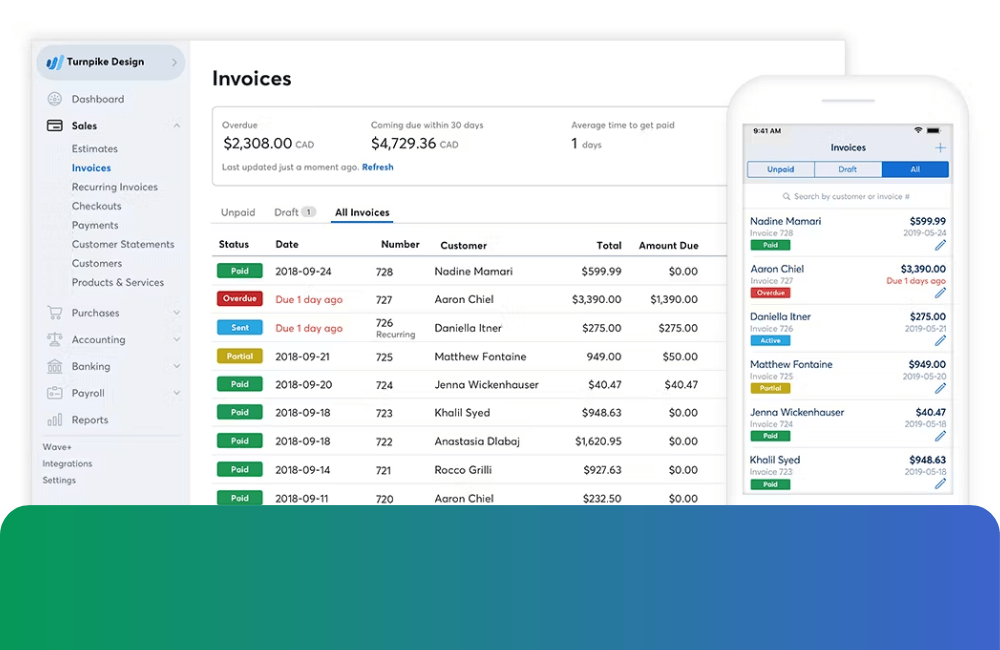

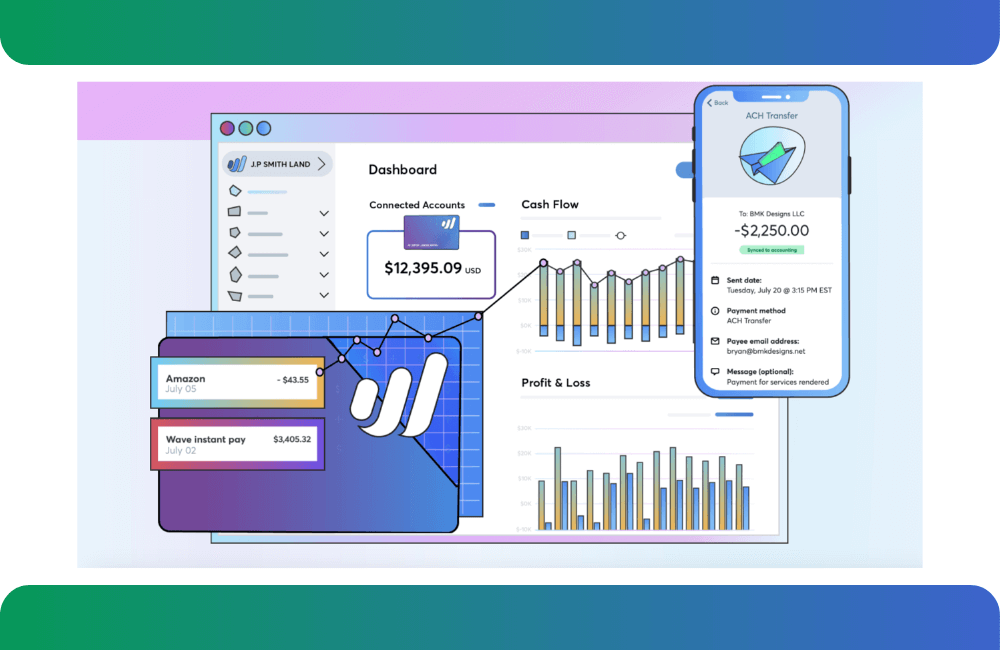

Wave

Wave is a free accounting software for small businesses. It provides a straightforward platform for invoicing, expense tracking, and basic financial reporting. The software is a good choice for freelancers and single-owner operations looking to get their finances organized without an upfront cost. While its primary accounting features are free, Wave generates revenue from payment processing and payroll services.

Key Features:

- Free invoicing and expense tracking.

- Unlimited professional invoices.

- Income and expense reporting.

- Mobile receipt scanning.

- No monthly subscription fees.

Square

Square is primarily known for its payment processing, but it has grown into a full business management platform with robust accounting functions. It is a top choice for retail businesses, restaurants, and professional service providers. Square provides a unified system for accepting payments, managing sales, and recording financial data. It is a strong contender when you compare small business accounting software for businesses that need an integrated point-of-sale system.

Key Features:

- Deep integration with Square’s POS system.

- Real-time reporting on sales and revenue.

- Integrated banking, savings, and loan products.

- Automated sales and payment reconciliation.

- Tools for managing inventory and employees.

What to Consider When Choosing Bookkeeping Software for Your Business?

Choosing the right bookkeeping/accounting software for your business requires a careful look at several factors. The right choice will match your current needs and also support your future growth.

Ease of Use

The software should be straightforward for you and anyone on your team to learn and operate. A cluttered or confusing interface can create frustration and lead to mistakes. Look for a clean dashboard that provides a simple overview of your finances and clear navigation to all functions.

Features

A software solution should have the functions you need to run your business smoothly. At a minimum, look for expense tracking, invoicing, and reporting. Other useful features include payroll management, inventory tracking, and time tracking. Make a list of your must-have and nice-to-have features before you start.

Integrations

Your bookkeeping software should work well with the other tools you already use. Connections with your bank accounts, credit cards, and payment processors can automate transaction imports and save a lot of time. Integrations with your CRM or e-commerce platform can also streamline your workflow.

Cost

Accounting software comes in a range of prices. Many companies have tiered subscription models, with costs based on the number of users or features you need. Some have a free version for very small businesses. Compare not just the monthly fee, but also the total cost, including potential add-on features and support fees.

Scalability

A business that is growing needs software that can grow with it. Your accounting solution should be able to handle an increasing number of transactions and users without a drop in performance. Choosing a scalable platform now can save you from a complex and time-consuming migration to new software in the future.

Support

Even the most intuitive software can have issues. A dependable support team is a valuable asset. Look for a company that provides multiple ways to get help, such as live chat, phone support, or an extensive knowledge base.

When a Custom Accounting Software is the Answer?

While the top 10 accounting software options are a fit for most small businesses, some companies find themselves with needs that a standard solution can’t fully meet. This is common for firms with highly specialized workflows, unique inventory types, or complex reporting requirements. When a standard app requires too many workarounds or expensive third-party add-ons, a custom solution becomes a logical next step.

A custom-built accounting system is designed to fit your exact business model. It can provide a competitive edge by streamlining unique processes and automating tasks that are specific to your operations. Building a custom solution also provides greater control over security, data, and future integrations.

If you have complex needs that your current software cannot meet, a custom solution may be the answer. A specialized software development partner can build a system tailored to your business, ensuring every function works exactly as you need it.

For businesses with highly specific needs, a custom-built solution is a viable path forward. This is where a strategic partner like GEM Corporation comes in. The Vietnam-headquartered IT service and consulting firm has a growing footprint in key international markets, including Japan, South Korea, ANZ, the EU, and the US. With a team of over 400 engineers and a track record of more than 300 successful projects, GEM works with firms of all sizes to build tailored digital solutions. Their expertise in application development, AI, and data engineering gives them a strong foundation for creating custom accounting systems that fit a company’s exact processes.

GEM’s commitment to excellence is backed by globally recognized standards and partnerships:

- ISO/IEC 27001:2022, ISO 9001:2015, and CMMI Level 3 certified for software development

- ISTQB Gold Partner for Quality Governance

- Official Consulting Partner of Databricks and ServiceNow

Conclusion

The right accounting solution is a foundation for any small business’s success. While finding the perfect fit can seem challenging, the top 10 bookkeeping software on our list covers a wide range of needs. From free tools for freelancers to scalable systems for growing firms, a solution exists for every business type. Remember to consider factors like features, cost, and scalability when making your choice. For businesses with unique needs that go beyond standard software, a custom solution is a path to consider.

Contact us to discuss how a tailored accounting system can work for your business.